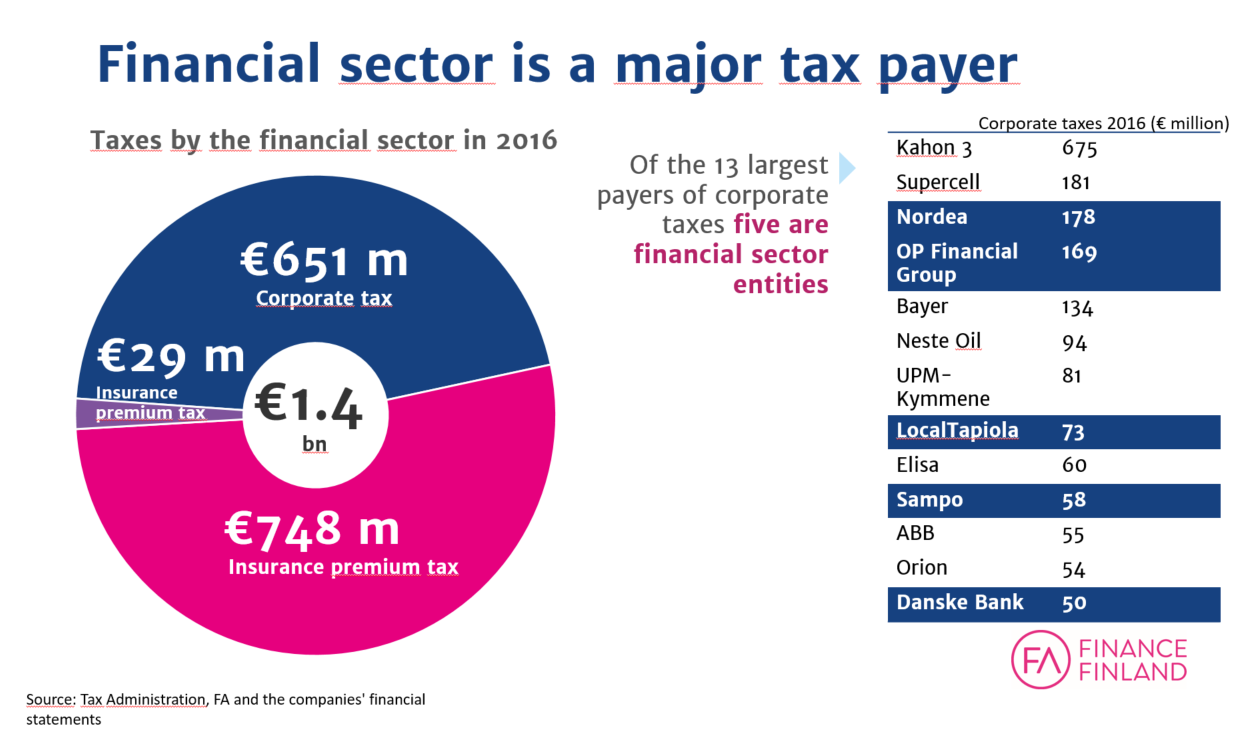

The Finnish financial sector was one of the main taxpayers in 2016 as well. The sector contributed a total of €651 million in corporate tax, which is approximately 12% of Finland’s total corporate tax income. The thirteen largest payers include five financial companies.

The financial sector’s overall tax footprint is €2.9 billion. This sum includes corporate tax (€651m), insurance premium tax (€748m), VAT, and taxes and social security contributions withheld from employee salaries. The financial sector employs approximately 40,000 people in Finland.

“Finland has established itself as a stable and tempting environment for the financial sector. This is demonstrated by Nordea moving its headquarters to Finland and some Nordic fund management companies being located in Finland”, says Veli-Matti Mattila, chief economist at Finance Finland. “We must ensure that Finland remains a stable and predictable operational environment. When regulation and taxes are kept reasonable, the sector can best support economic growth and competitiveness.”

Finland’s two largest corporate tax payers in 2016 were Kahon 3, the company that acquired Supercell, and Supercell itself, but these were followed by the Nordea Group with its €178 million tax contribution and the OP Financial Group with its €169 million. Other major tax payers in the financial sector included the LocalTapiola Group (€73m), the Sampo Group (€58m, including If P&C Insurance Company and Mandatum Life) and Danske Bank (€50m). All these companies were among the thirteen largest corporate tax payers in Finland. The groups’ tax contributions were collated from data published by the Finnish Tax Administration.

Insurance premium taxes burden customers

Despite being one of the major corporate tax payers, the financial sector contributed even more in insurance premium taxes, which totalled €748 million. Insurance premium tax is included in the price of some insurance policies although VAT is otherwise not applicable for insurance. In practice, the insurance premium tax equals VAT.

“The insurance premium tax was originally intended as a temporary remedy to the state budget. But it came to stay and now burdens those customers who want to independently insure themselves for example against damage to property. Insurance premium tax should first be disconnected from the standard rate of VAT and then removed altogether”, explains Mattila.

Still have questions?

|Contact FFI experts