Even a prolonged service disruption will not stop in-store payments – Finance Finland publishes report on the resilience of card-based payments

New Chair of Finance Finland’s Board Timo Ritakallio: Europe is waking up to the heaviness of financial regulation – Finland should do the same

Saving and borrowing survey: Finnish investors value convenience and returns

News article

20 Feb 2026

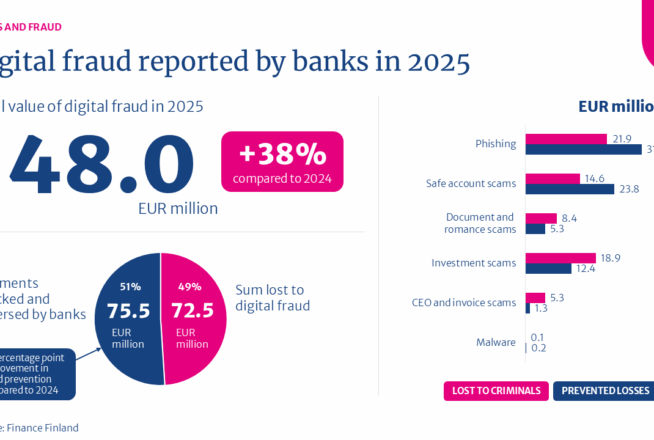

Total value of attempted digital fraud climbed to €148 million in 2025, but banks successfully intercepted more than half of the payments

Column

16 Dec 2025

Cash is about more than just ATMs and shops – how can we secure Finland’s cash supply?

News article

26 Nov 2025

Head of Cabinet Michael Hager: Europe will not prosper simply by avoiding mistakes – Financial supervisors must look after competitiveness and growth

Total value of attempted digital fraud climbed to €148 million in 2025, but banks successfully intercepted more than half of the payments

20 Feb 2026Even a prolonged service disruption will not stop in-store payments – Finance Finland publishes report on the resilience of card-based payments

13 Feb 2026New Chair of Finance Finland’s Board Timo Ritakallio: Europe is waking up to the heaviness of financial regulation – Finland should do the same

5 Jan 2026Season’s Greetings – Finance Finland has made a donation to youth mental health work to help prevent loneliness, bullying and social isolation

15 Dec 2025Banks and operators crack down on scam sites – new anti-fraud model enables faster response times

10 Dec 2025

Capital Markets Union, EU, SAVING AND INVESTING, TAXATION

Nordic comments on ”Way to report”

23 Feb 2026

EU, SAVING AND INVESTING, TAXATION

EU Commission: FASTER xsd

26 Jan 2026

Capital Markets Union, EU, SAVING AND INVESTING

Finance Finland’s response to Commission’s call for evidence for an initiative on recommendation on Savings and Investment Accounts

26 Sep 2025

Capital Markets Union, EU, SAVING AND INVESTING

Targeted consultation on supplementary pensions

28 Aug 2025

EU, Funds, SAVING AND INVESTING, TAXATION