A popular form of investment

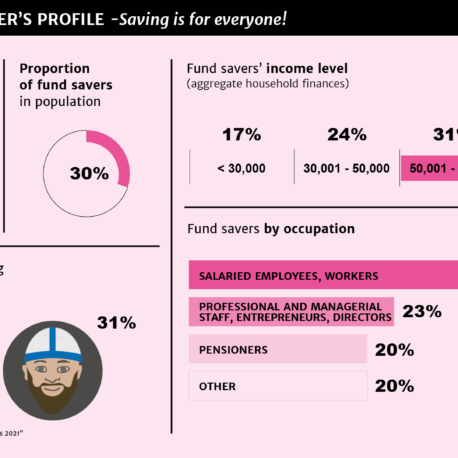

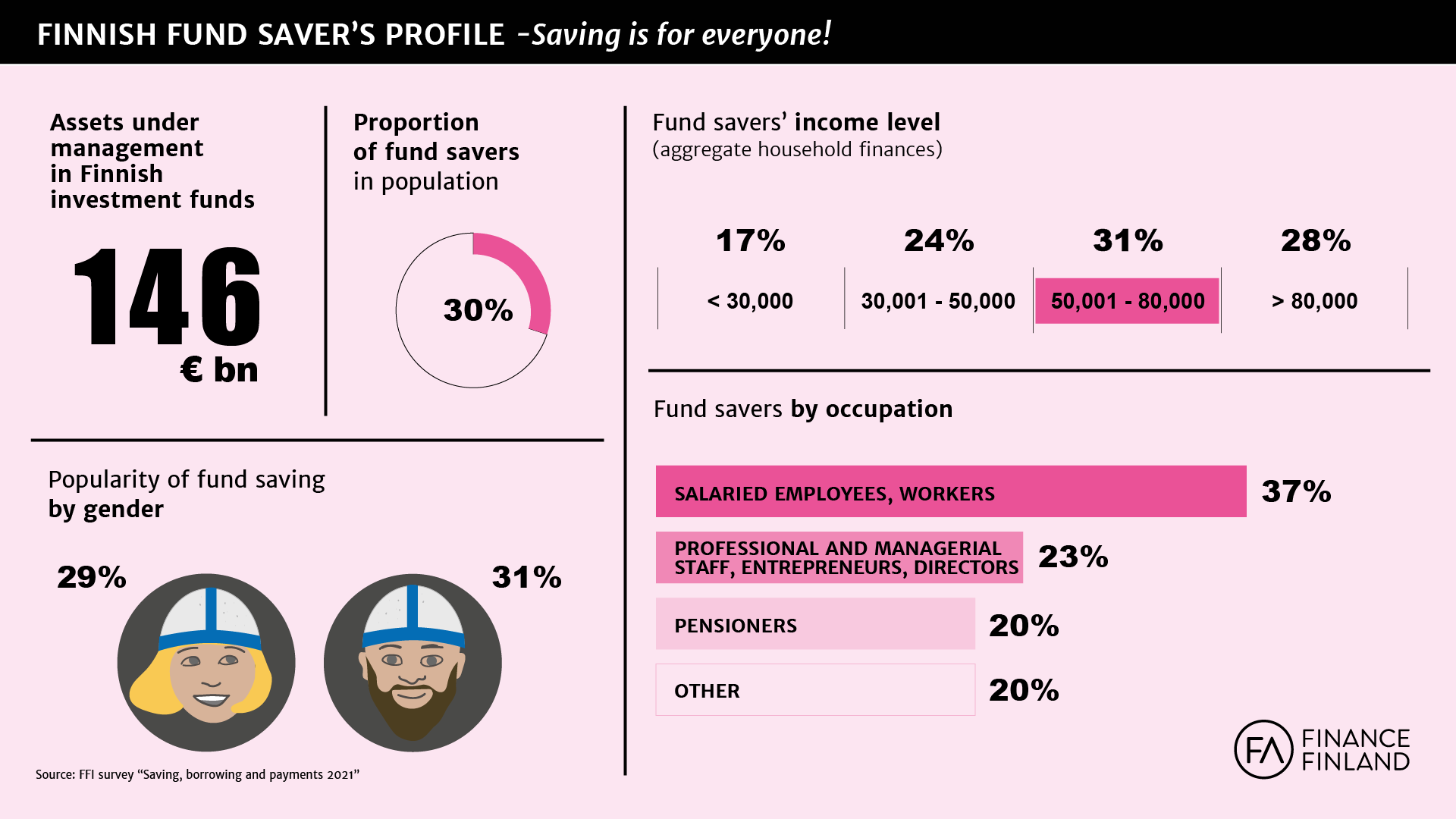

Saving in investment funds has been on the increase among Finns in recent years. There are over 450 registered investment funds in Finland, and a million Finns have made fund investments. The combined assets of Finnish investment funds totalled €134 billion at year-end 2020.

Finnish investors also have access to nearly 500 investment funds registered in other countries.

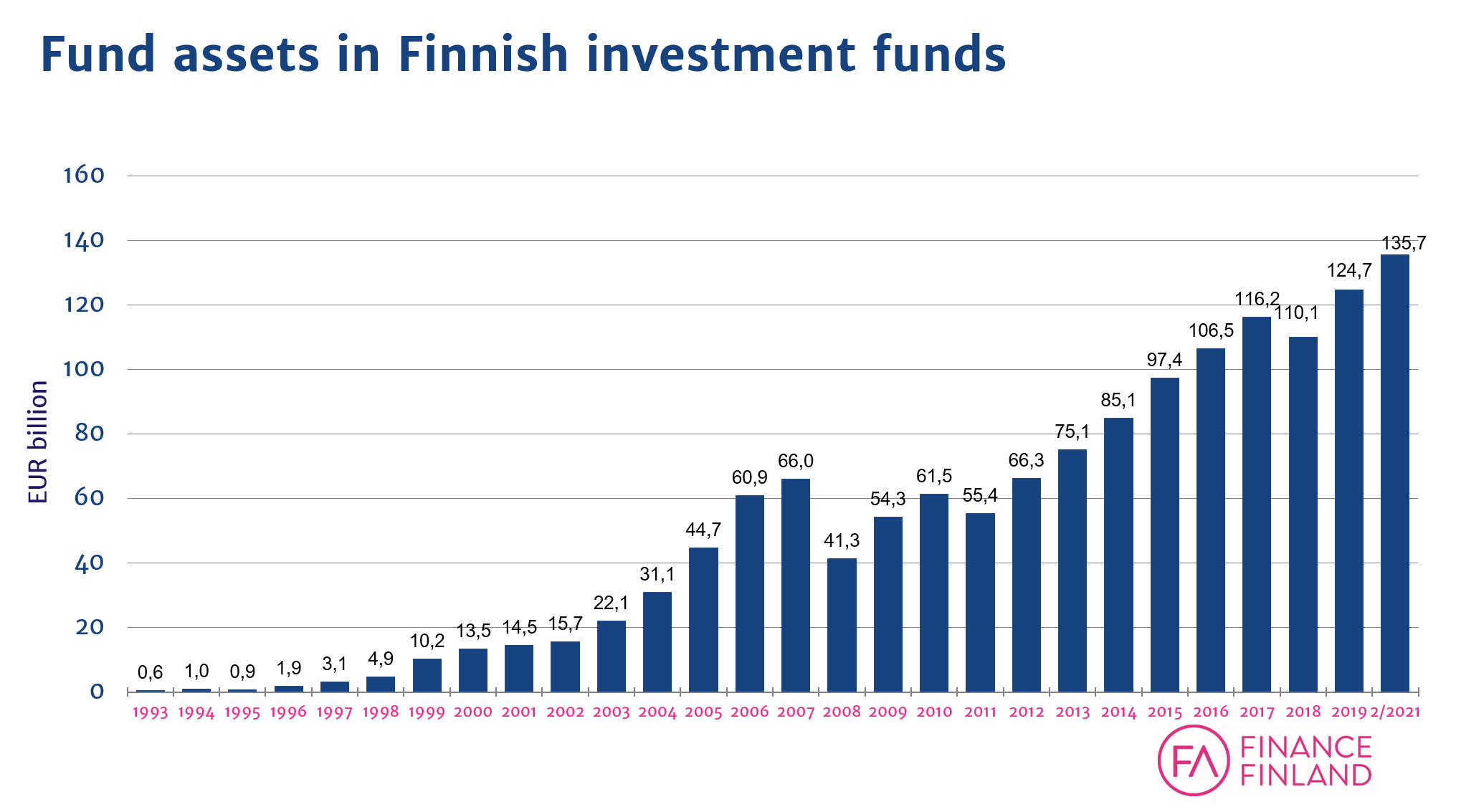

An investment fund is maintained by a fund management company, which collects money from private persons and organisations and invests it in several different securities. These securities form the fund.

The fund management company does not own the investment fund – its owners are the individuals, organisations and foundations who have invested in the fund. One investment fund is divided into equal units which give equal rights to the fund’s assets.

The rate of return on a investment fund comes from the development of the investment market, which means that anything that happens in the market is reflected on the value of investment funds. Product development is active, and as a result, new kinds of funds pop up in the market all the time.

Fund management is supervised by the Finnish Financial Supervisory Authority (FIN-FSA) and highly regulated at both national and EU level. It is subject to the EU UCITS Directive and the Finnish Act on Common Funds. Alternative funds are regulated by the EU AIFM Directive and the Finnish Act on Alternative Investment Fund Managers.

Filter

Still have questions?

|Contact FFI experts