- Finns withdrew 6% less cash in the second half of 2024 compared to the same period the previous year, show the Bank of Finland’s payments statistics.

- Finnish banks’ customers made a total of 28.2 million cash withdrawals totalling €4.1 billion at ATMs, bank branches and POS terminals.

- Over the course of the entire year, the number of cash withdrawals was lower than in any previous year.

- Only 7% of Finns used cash as their primary payment method for daily purchases in 2024.

The Bank of Finland’s payments statistics show a continuously declining trend in cash usage and cash withdrawals. Between July and December 2024, Finns withdrew 6% less cash than in the second half of 2023. Over the course of the entire year, the number of cash withdrawals was lower than in any previous year.

Only 7% of Finns used cash as their primary payment method for daily purchases in 2024.

“Nordic consumers use much less cash than their peers in Middle and Southern Europe. But cash does have its uses also in Finland, and it will retain its status as a payment option also in the future”, points out Finance Finland’s Head of Card Payments Kirsi Klepp.

Finnish payment service providers’ customers made a total of 28.2 million cash withdrawals totalling €4.1 billion at ATMs, bank branches and point-of-sale (POS) terminals. In comparison with the second half of 2023, this represented a year-on-year decrease of 7.8% in terms of the number of withdrawals and 6.1% in value.

No point in increasing the volume of cash without real demand

The European Commission is preparing new regulation on the legal tender of euro cash, which may result in an increase in the volume of cash in circulation. Klepp remarks that there is no reason to artificially boost the volume of cash without a real market-based need or demand. Doing so could drive up costs for consumers, businesses and society without bringing any tangible benefits in return.

“Retail payments in Finland are mainly based on cards and other digital payment methods. This is also evident in the central bank’s statistics. Consumers prefer digital payment methods in both shops and peer-to-peer payments, and service providers offer what consumers want. Increasing the volume of cash in circulation is unlikely to translate into increased usage.”

Klepp does not believe cash will ever fully disappear but expects that its volume will grow smaller – and that it will have new manifestations, such as the digital euro.

“Whether they prefer card, mobile or cash payments, or some entirely new method yet to be innovated, the future of payments is ultimately dictated by consumers and their needs.”

Still have questions?

|Contact our experts

Looking for more?

Other articles on the topic

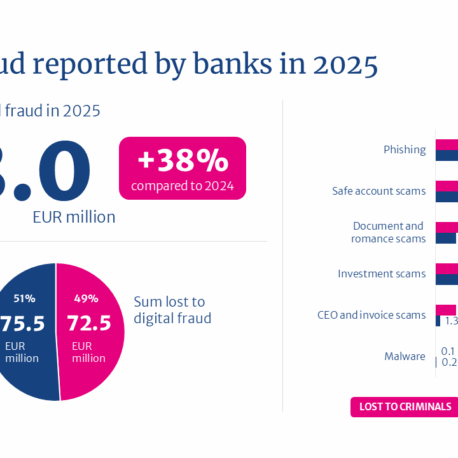

Total value of attempted digital fraud climbed to €148 million in 2025, but banks successfully intercepted more than half of the payments

Even a prolonged service disruption will not stop in-store payments – Finance Finland publishes report on the resilience of card-based payments

Cash is about more than just ATMs and shops – how can we secure Finland’s cash supply?

FIN-FSA surveyed financial sector companies’ use of AI – from crunching data to fighting financial crime