- European financial sector regulation has expanded and become increasingly complex, which has begun to hamper the sector’s operations and increase costs. The problems of regulation stem especially from its sheer volume and level of detail.

- Shortcomings and ambiguities in the regulatory process result in interpretation issues, and companies are calling for clarity and predictability.

- The solution is simplification. The mandate of national and European financial supervisors must be balanced so that competitiveness and economic growth are integrated as complementary goals alongside stability.

- Finance Finland’s Less is More EU seminar addressed the challenges of European financial regulation. The seminar’s keynote was delivered by Michael Hager, Head of Cabinet to Commissioner Valdis Dombrovskis. The panel discussion featured Under-Secretary Leena Mörttinen from the Ministry of Finance, Associate Professor Heikki Marjosola from the University of Helsinki, and President and Group CEO of OP Pohjola Timo Ritakallio.

The seminar was rooted in the European Banking Federation’s (EBF) discussion paper Less Is More, which also discussed the problems of regulation and the need to ensure that regulation and supervision remain both effective and proportionate.

Finance Finland’s Less is More seminar, held on 19 November 2025, explored problems and solutions related to EU financial sector regulation. In recent years, the sector’s regulation has grown rapidly in scale and complexity.

Regulatory streamlining has gained heavy political momentum in the EU after the Commission set simplification as one of its key priorities in strengthening European competitiveness.

The seminar’s keynote speaker was Michael Hager, Head of Cabinet to Commissioner for Economy and Productivity Valdis Dombrovskis. In his keynote, Hager made essentially the same recommendation as Finance Finland’s Chair Sara Mella in her statement earlier that day: competitiveness must be integrated into the mandate of financial supervisors. He also emphasised that the EU must be able to respond to challenges such as geopolitical turmoil and climate change.

The EU must be able to finance important strategic projects without stifling its own financial sector. According to Hager, it is essential for regulation and supervision to take EU competitiveness into account in order to avoid suppressing growth and to enable Europe to invest in its future.

“Competitiveness must be included, not to replace stability and not to weaken supervision but as a structural element alongside simplicity”, Hager said.

Balance between stability and growth is necessary

“Finnish regulators provide clear deadlines on legal entry into force and also allow sufficient time for implementation. Some of the EU regulation, on the other hand, arrives in a slow trickle, and the content that is the most essential for sector participants is only available at the last minute. This is unreasonable, because the regulation may require major changes to IT systems but yet leave no time for their implementation”, OP Pohjola President and Group CEO Timo Ritakallio criticised in the panel.

In the aftermath of the 2008 financial crisis, Ritakallio pointed out, the increase of regulation was justified also from the banking sector’s viewpoint: after all, a stable financial system is important for banks, too. However, the increase in regulation continued long after the waves of the crisis settled – and instead of abating has only grown further in recent years.

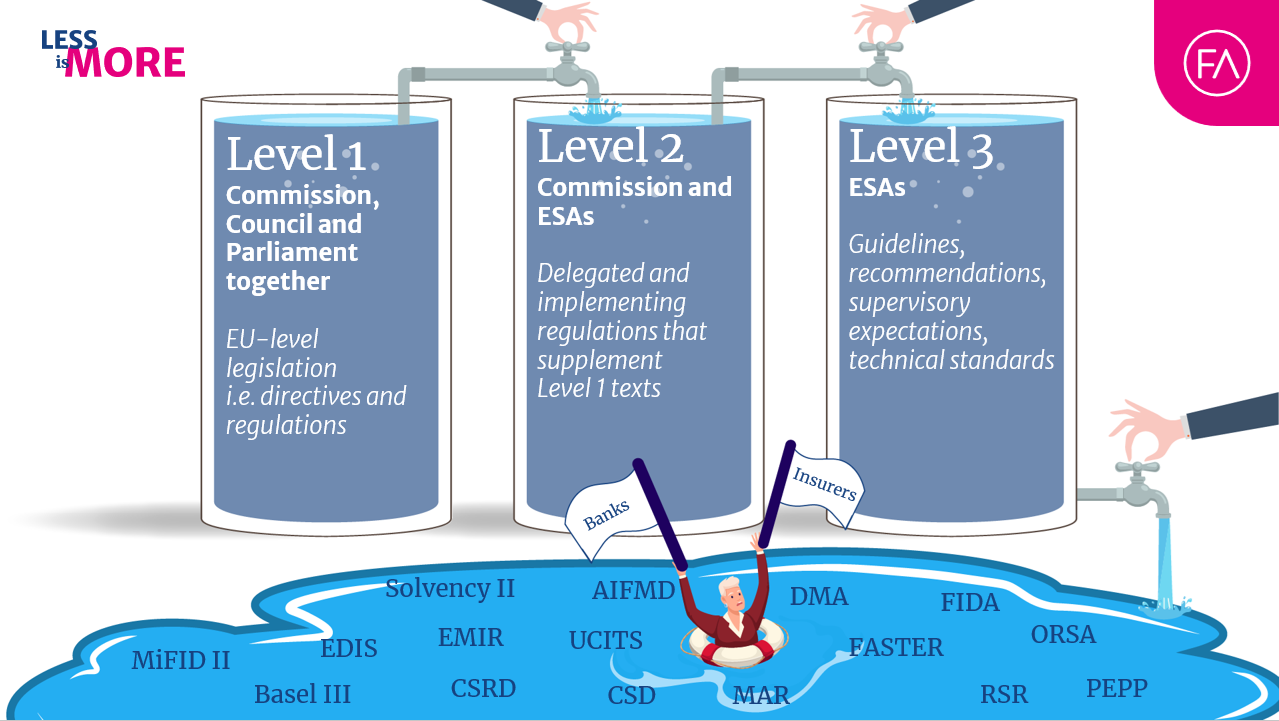

Financial sector regulation consists of national and EU legislation (Level 1) in addition to delegated and implementing regulations (Level 2) given by supervisors and European supervisory authorities that supplement and clarify the higher-level texts. Regulation also includes a third level, which comprises even more detailed recommendations, interpretations and guidelines issued by the ESAs. While Level 3 regulation is not binding in the same way as laws are, it has a strong steering effect on how businesses operate.

With regulation pouring in from all levels, the page count of a single regulatory package can easily reach several thousand. Such a massive amount of legal texts is so difficult to manage, it only further complicates operations and leads to higher costs.

“Merely keeping up with the volume and detail of regulation ties up organisational resources, leads to additional costs, hampers operations and creates obstacles to European competitiveness. Moreover, when regulation is excessive and needlessly detailed, its risk-based approach is lost”, Ritakallio explained.

Deficient legislative processes often result in interpretation issues. Associate Professor of Financial Law Heikki Marjosola from the University of Helsinki commented that market participants tend to seek clarity in such situations.

“Companies need to know how they should act and how the law is interpreted, and Level 3 regulation usually responds to this need”, Marjosola said.

According to Ministry of Finance Under-Secretary Leena Mörttinen, there is demand for guidelines issued as Level 3 regulation, because ambiguities of interpretation keep companies on their toes and in fear of supervisory sanctions. Mörttinen also believes that a review of supervisory mandates is necessary and that the regulatory process should always include economic impact assessments.

“The stream of regulation can’t be stopped, but its flow can be reduced and managed on Level 3”, Mörttinen concluded.

The proposed extension of the ESAs’ and national financial supervisors’ mandate does not mean loosening supervision but rather balancing it. When the conditions for economic growth are considered alongside stability, European competitiveness improves and regulation becomes more functional and expedient. Timo Ritakallio invited the audience to reflect on the ultimate purpose of regulation.

“The aim of post-crisis regulation was precisely this: supporting and safeguarding competitiveness and economic growth through periods of crisis”, said Ritakallio.

Still have questions?

|Contact our experts

Looking for more?

Other articles on the topic

Head of Cabinet Michael Hager: Europe will not prosper simply by avoiding mistakes – Financial supervisors must look after competitiveness and growth

The Nordic model for European savings and investments accounts is simply excellent – The Commission would be wise to look to the North

Commission unveils proposal to revive securitisation, aiming to strengthen EU capital markets

How much would the digital euro cost? Initial estimation published