- 27% of the respondents to a recent survey had claimed compensation from one of their insurance policies over the last year.

- Families with children had incurred more damages, with up to 44% of such respondents having claimed compensation over the last year.

- Only 5% of claims had been rejected. Of all respondents, 86% considered the received amount of compensation to be proportionate to the loss they had incurred.

- Compensation was most often claimed from home insurance (30%) and comprehensive motor vehicle insurance (22%).

- The results are from a survey commissioned by Finance Finland and undertaken by Norstat Finland. The survey was conducted in spring 2025, and its respondents included about a thousand Finns aged 18 to 79 years living in mainland Finland.

Insurance rarely gets positive publicity, but practical experiences paint a much less grim picture. According to a recent survey commissioned by Finance Finland, the majority of Finns are satisfied with their insurance service, and the number of rejected claims is very small.

A generous one in four Finns (27%) had claimed compensation from at least one of their insurance policies over the last year. Only 5% of the claims were rejected, which means the vast majority received compensation for their losses. Of all respondents, 85% were satisfied with their service, and up to 62% even described it as excellent. Most (86%) also considered the received amount of compensation to be proportionate to the loss incurred.

According to Finance Finland’s Director of Legislation Hannu Ijäs, the survey results serve as proof that the Finnish insurance system is functioning well.

“Rejected insurance claims often receive a lot of negative attention in informal conversation and the media, but in reality, the majority of customers are happy with their service. For example, the notion that insurance companies intentionally interpret terms and conditions as strictly as possible in order to wriggle out of paying compensation is not supported by the survey results.”

Silent but content majority values security and ease of daily life

According to Ijäs, the high satisfaction figures may be elevated also by the numerous other services that insurance companies provide in addition to compensations.

“Depending on the product, the insurer can also provide other kinds of tangible support in difficult situations besides financial compensation. For example, for someone involved in a car accident, a smooth and hassle-free repair process at the insurer’s partner garage and a replacement car will be very valuable”, Ijäs says.

Besides financial security and tangible assistance, insurance also offers more abstract benefits.

“In the end, the most important feature of insurance may just be the sense of security it offers. Insurance allows for peace of mind – the certainty that if something bad happens, at least it won’t lead to financial ruin”, Ijäs concludes.

Still have questions?

|Contact our experts

Looking for more?

Other articles on the topic

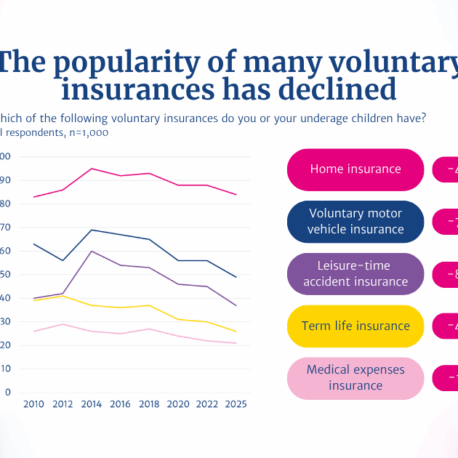

2025 Insurance Survey: Finns have fewer voluntary insurance policies than before

Finns are happy with their insurances – 86% consider compensations proportionate to the suffered loss, and claims are rarely rejected

Customers are already protected if an insurance company fails – An EU-wide insurance guarantee scheme is not needed

Financial sector’s VAT treatment needs an overhaul, but the Finnish pension system must not be hampered with added tax burden