- The financial sector was once again one of the biggest taxpayers in Finland according to the 2024 tax data released by the Tax Administration.

- Financial sector companies paid €1.3 billion in corporate income tax, which is roughly the same as in 2023.

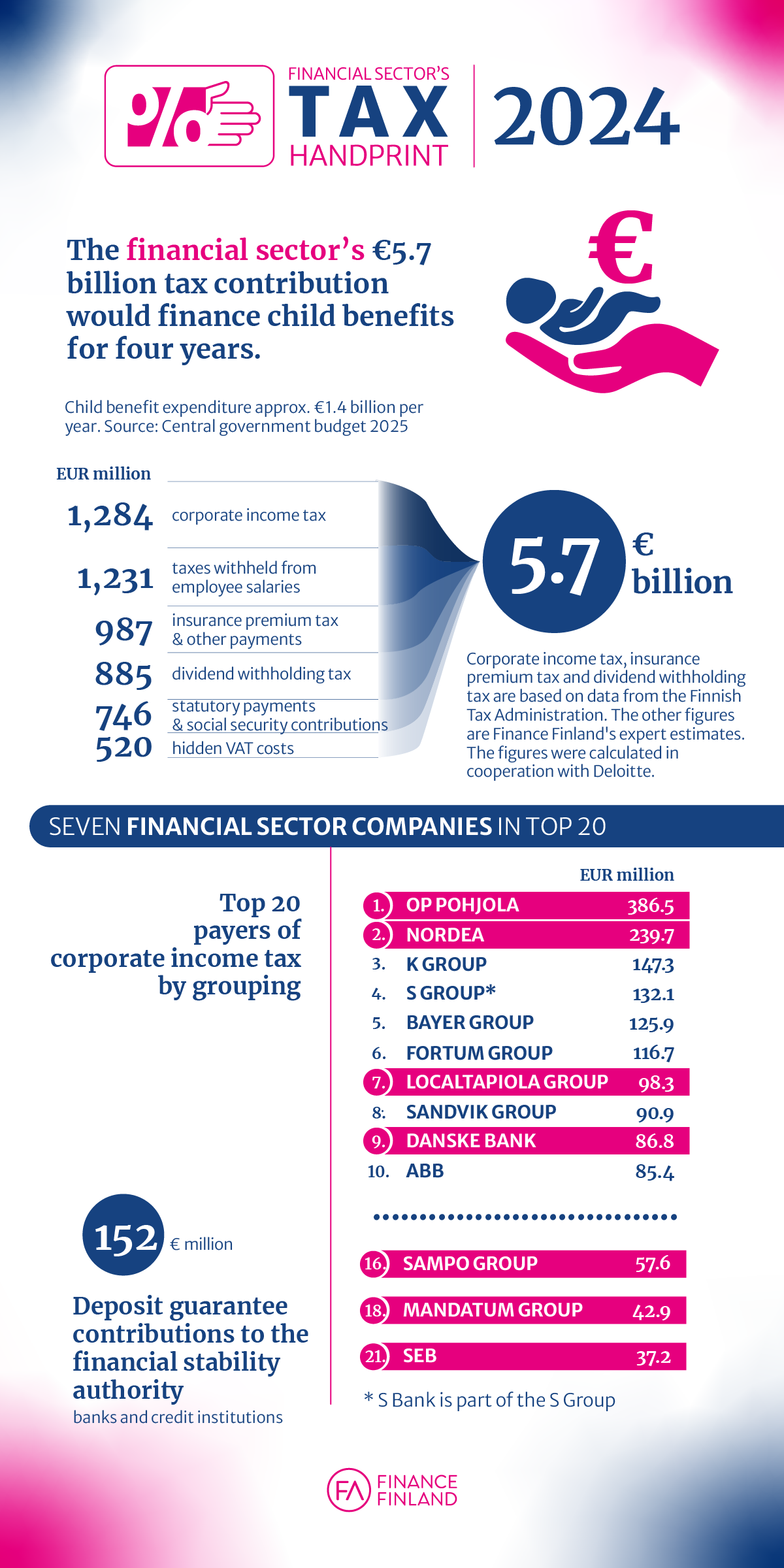

- OP Pohjola led the national corporate tax statistics with €386.5 million, followed by Nordea with €239.7 million. LocalTapiola ranked seventh and Danske Bank ninth in the listing.

- Finance Finland and Deloitte calculated the total taxes paid by financial groups and their subsidiaries and compiled a list of Finland’s biggest payers of corporate tax across all sectors.

- The financial sector’s total tax handprint in 2024 was €5.7 billion.

The sources used in the calculation of the sector’s tax handprint include the Finnish Tax Administration, Statistics Finland, companies’ financial statements and Finance Finland. The corporate income tax figures were calculated in cooperation with Deloitte.

Once a year, on Finland’s national “tax day”, the Tax Administration releases public data on taxes paid by Finnish businesses and residents the previous year. While media coverage often focuses on the earnings of well-known public figures, the taxes paid by companies are also reported. Based on this data, Finance Finland calculates and compiles a list of the corporate groups that contributed the most in corporate income tax. Year after year, financial sector companies rank among the top taxpayers. This underlines the importance of the financial sector’s operations to the Finnish welfare state.

The financial sector’s largest corporate income tax payer in 2024 was OP Pohjola, followed by Nordea in second place. The sector’s corporate income tax contribution of €1.3 billion represents about 18.3 per cent of Finland’s total corporate income tax revenue.

“The top 25 payers of corporate income tax included no fewer than seven financial companies. This is a good reminder of the importance of banks and insurers as major taxpayers and key pillars of the Finnish welfare state. The sector’s total tax handprint is one of the largest in Finland”, says Finance Finland’s CEO Arno Ahosniemi.

Finland’s total corporate income tax revenue in 2024 was €7 billion, which is roughly the same as the previous year.

The largest payer of corporate tax in Finland was OP Pohjola (€397.5 million), followed by Nordea (€239.7 million), retailing conglomerate K Group (€147.3 million) and retailing cooperative S Group (€132.1 million).

The next biggest taxpayers in the financial sector were LocalTapiola Group (€98.3 million, 7th), Danske Bank (€86.8 million, 9th), Sampo Group (€57.6 million, 16th), Mandatum Group (€42.9 million, 18th) and SEB (€37.2 million, 21st). S Bank, which is part of the S Group, would have ranked 26th on its own (€33.3 million).

Finance Finland compiled the financial sector data based on public information provided by the Finnish Tax Administration. Other sectors’ figures have also been calculated at group level. The figures were calculated in cooperation with Deloitte.

The financial sector’s tax contribution would finance nearly four years of child benefits

“The sector’s tax handprint totalled €5.7 billion in 2024. This amount would be enough to finance child benefits for nearly four years. The 2025 budget allocates €1.4 billion to child benefits”, Ahosniemi notes.

The tax handprint for the sector is calculated from its corporate income tax (€1.3 billion), insurance premium tax (€963 million) and contributions towards fire protection, road safety and industrial safety (€24 million). The sector also generates employee income tax (€1.2 billion), social security contributions (€746 million) and dividend withholding tax (€885 million), and pays hidden VAT costs of €520 million.

€152 million into deposit protection

In addition to taxes and other statutory payments, credit institutions are required to contribute to the Deposit Guarantee Fund, which safeguards depositors’ claims in banks. In 2024, credit institutions and banks paid a total of €152 million in deposit guarantee contributions to the Financial Stability Authority.

The FSA previously also collected stability contributions for the EU Single Resolution Fund. As the fund reached its target at the end of 2023, no EU stability contributions were collected from banks in 2024.

Still have questions?

|Contact our experts

Looking for more?

Other articles on the topic

The financial sector is one of the biggest taxpayers in Finland – The sector’s €5.7 billion tax contribution would cover child benefits for nearly four years

Financial sector’s VAT treatment needs an overhaul, but the Finnish pension system must not be hampered with added tax burden

The Nordic financial sector calls for harmonised implementation of the FASTER Directive

Income taxes paid by financial sector companies grew to €1.3 billion in 2023, and the sector’s total tax handprint of €5.6 billion would cover Finland’s military expenditure – OP Financial Group and Nordea the two largest taxpayers in Finland