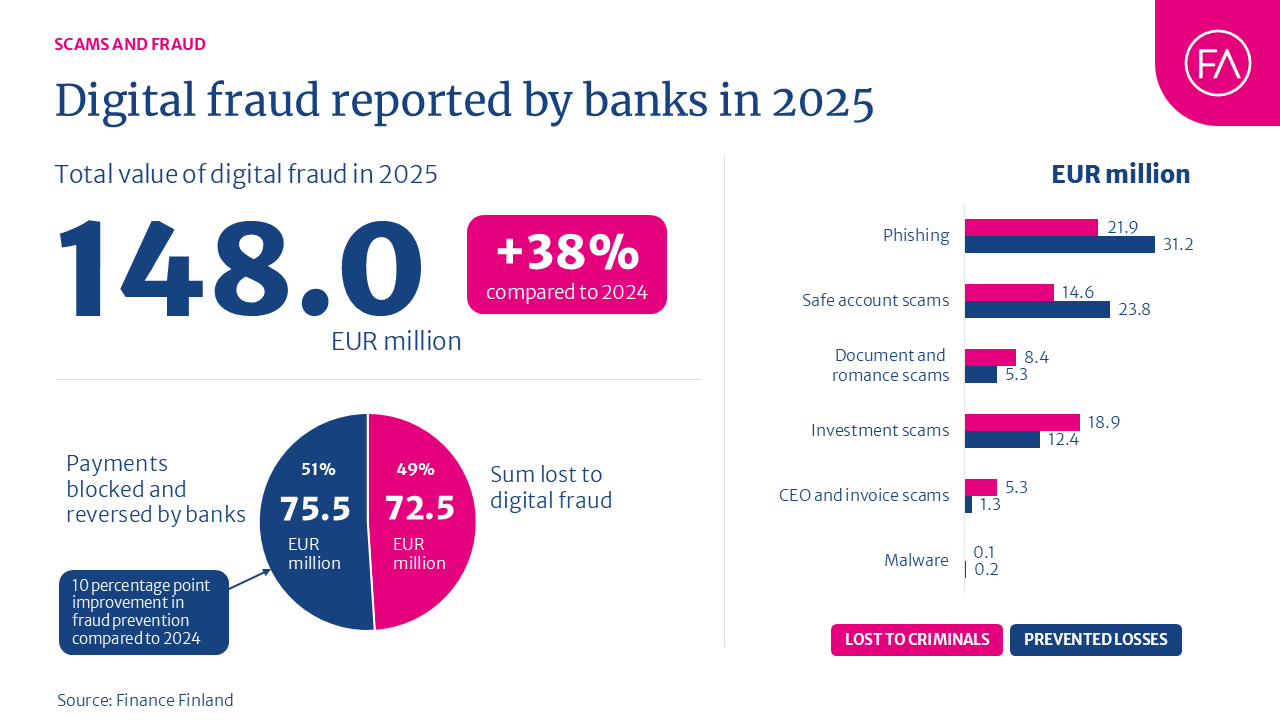

- In 2025, the total value of attempted digital fraud reached €148 million in Finland, according to bank data compiled by Finance Finland. In 2024, the value of attempted fraud was €107.2 million.

- Banks successfully blocked or recovered €75.5 million worth of fraudulent payments.

- Funds lost to criminals totalled €72.5 million.

- This means more than half of the payments made to criminals were blocked or recovered. In 2024 the figure stood at just over 40%.

Fraudsters attempted to steal a total of €148 million from Finns in 2025. Of this total amount, banks were able to stop or reverse €75.5 million of fraudulent transactions to criminals, and the final losses amounted to only half at €72.5 million. This figure is still higher than in the previous year, when total losses to digital fraud stood at €62.9 million.

“Although banks managed to intercept more than half of the payments to criminals, the amount of money lost is alarming. Technology is both our ally and adversary in fraud prevention: AI enables criminals to mass produce convincing fake profiles and phishing messages in fluent Finnish. On the other hand, AI also helps banks and authorities detect fraud more quickly than humans can”, says Niko Saxholm, head of security and loss prevention at Finance Finland.

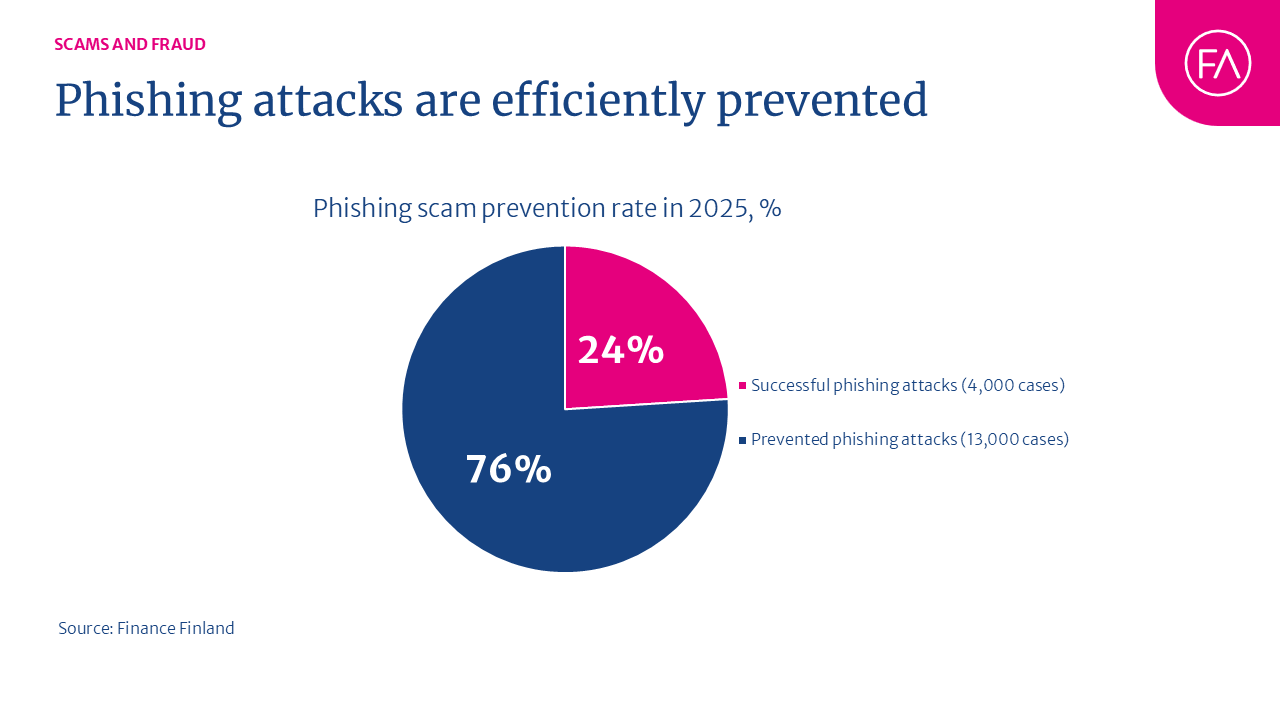

The biggest losses came from phishing scams, which targeted almost 17,000 people and totalled €53.1 million. Banks were able to block or recover €31.2 million of these payments, saving the funds of 13,000 people. This indicates a 76% success rate. The success rate of phishing prevention was calculated for the first time in the 2025 report.

“The total amount of money saved through all types of fraud prevention measures cannot be accurately estimated, but the value of phishing scams that were intercepted – that is, cases in which money had already been or was about to be transferred – exceeds €53 million. We’re talking about significant sums here”, Saxholm points out.

Safe accounts are a persistent lie

Up to 60% of fraud cases – more than in previous years – involved the customer voluntarily transferring funds to criminals. This year’s statistics include the new category of safe account scams, which were previously classified under phishing. In 2025, money stolen through safe account scams totalled €38.4 million. Banks were able to block or recover €23.8 million of these payments.

In a typical safe account scam, the criminal poses as a bank employee and calls the victim to warn them that a large payment is about to be made from their account. The customer is manipulated into handing over their credentials and approving the transfer of the funds to a supposed safe account. Criminals often increase the credibility of the scam by listing out genuine transactions registered on the victim’s account, which they have obtained through unlawful access.

“There is no such thing as a safe account; such accounts have never existed. Banks are fully capable of safeguarding their customers’ funds without any specific approval. If the caller refers to safe accounts, they are a fraudster”, Saxholm emphasises.

The fraud statistics published by banks and the police differ to some extent because of the way fraud cases are reported. Banks’ figures are usually higher, as police statistics are based on reported offences. Victims of romance or investment scams in particular may often choose not to file a report. In addition, the criminal proceeds reported by the police are based on the sum given in the initial report of offence, which may have changed at a later time due to recovery or seizure of the stolen funds.

Still have questions?

|Contact our experts

Looking for more?

Other articles on the topic

Total value of attempted digital fraud climbed to €148 million in 2025, but banks successfully intercepted more than half of the payments

Even a prolonged service disruption will not stop in-store payments – Finance Finland publishes report on the resilience of card-based payments

Banks and operators crack down on scam sites – new anti-fraud model enables faster response times

Fraudsters have months to hook their victims – banks must prevent fraud in seconds