- The European Commission’s objective is to set out in secondary legislation what the legal tender status of euro cash means and to ensure the sufficient availability and acceptability of cash.

- If the proposal leads to the volume of cash being increased, it can drive up costs for consumers, businesses and society.

- There is no reason to increase the volume of cash without a real need or demand.

- Finland and the other Nordic countries use very little cash compared to the rest of Europe.

- Finance Finland and the Finnish Commerce Federation have published an overview on the proposal and the cash situation in Finland. A link to the paper is available at the end of this article.

The European Commission is preparing regulation on the legal tender of euro cash. If the regulation leads to the volume of cash being increased, it can drive up costs for consumers, businesses and society. There is no reason to artificially boost the volume of cash without a real market-based need or demand.

According to the Bank of Finland’s consumer survey, only 7% of Finns used cash as their primary payment method in daily shopping in 2024. Cash usage is much smaller in the Nordics than in Middle and Southern Europe, for example.

In Finland, the public sector has become almost fully cashless: healthcare charges are invoiced, and public transportation tickets can only be bought by card or online, for example.

“Retail payments in Finland are mainly based on cards and other digital payment methods. Cash will still have its own uses, but increasing its availability and acceptability without a real need can drive up costs”, says Finance Finland’s Head of Card Payments Kirsi Klepp.

The main reason cash usage is declining in Finland is changed consumer demand.

“Consumers prefer digital payment methods, and service providers offer what consumers want. No matter how much the volume of cash is increased, its usage will not increase.”

Klepp points out that the need for cash is further reduced by the growing popularity of digital peer-to-peer payment methods, such as the Nordic Vipps MobilePay, the Finnish Siirto payment and the European EuroPa and EPI.

Cash use is frequently justified with considerations of inclusion and the needs of vulnerable groups like senior citizens. Cash is unlikely to ever fully disappear, but forcefully steering vulnerable groups into using more cash may also contribute to digital exclusion and the inability to use digital services, which in the modern world are essential for personal financial management and access to important public services, such as personal healthcare information. The risk of digital exclusion is particularly great for younger people.

“Digitalisation enables the genuine privacy and tailoring of services to vulnerable groups and thus improves inclusion. Vulnerable groups mustn’t be steered away from digital services but rather encouraged and empowered in their use. Increasing the volume of cash does not enhance equality.”

Cash has its place – also in the future

Not everyone can or will use digital services, so cash will retain its status as a payment option also in the future. The Finnish private sector is strongly committed to maintaining cash services.

The declining use of cash is pushing up the costs, making it more and more difficult to organise cash services using a market-based approach. According to Klepp, a bigger role for national central banks should be considered. Some member states have already taken the first steps in this direction.

“Cash is unlikely to ever fully disappear, but its volume will grow smaller – and its next manifestation may be the digital euro. Whether they prefer card, mobile or cash payments, the future of payments is ultimately decided by consumers”, Klepp concludes.

Still have questions?

|Contact our experts

Looking for more?

Other articles on the topic

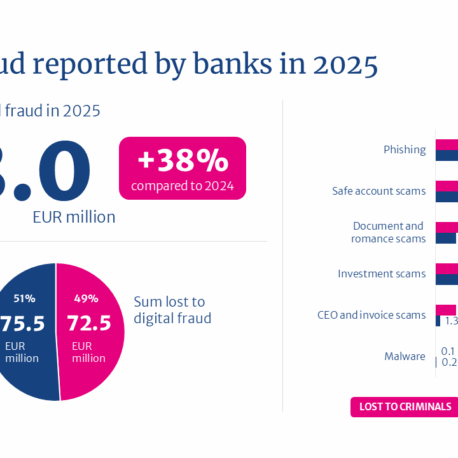

Total value of attempted digital fraud climbed to €148 million in 2025, but banks successfully intercepted more than half of the payments

Even a prolonged service disruption will not stop in-store payments – Finance Finland publishes report on the resilience of card-based payments

Cash is about more than just ATMs and shops – how can we secure Finland’s cash supply?

FIN-FSA surveyed financial sector companies’ use of AI – from crunching data to fighting financial crime