Strategy and values

VISION

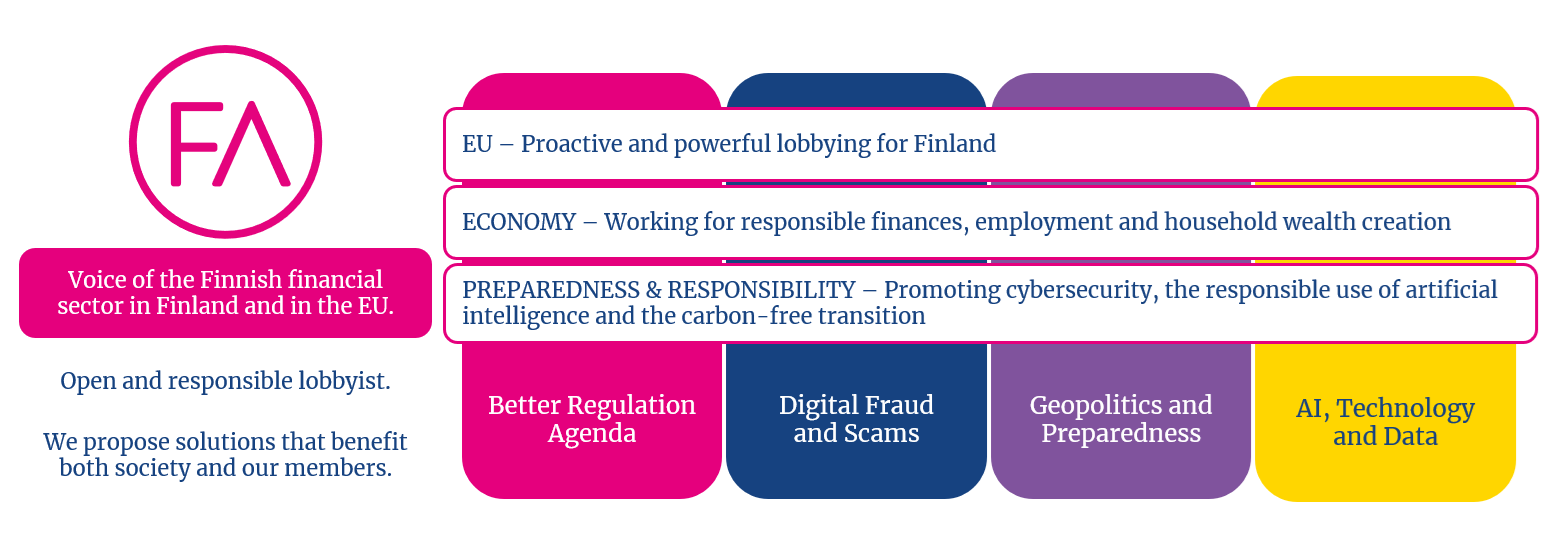

Finance Finland is an open and responsible lobbyist.

We propose solutions that benefit both our members and society.

MISSION

Finance Finland is the voice of the Finnish financial sector in Finland and in the EU.

STRATEGIC PRIORITIES FOR 2023–2026

1. EU – Proactive and powerful lobbying for sensible regulation and a stronger Finland

- Finance Finland must seize the window of opportunity opened by the EU’s regulatory fitness and performance agenda, and push for simplified regulation.

- Future EU initiatives will be shaped by the need to strengthen the Union’s strategic autonomy.

- The importance of efficient EU lobbying and having a visible presence in Brussels are becoming even more pronounced.

2. Economy – Working for responsible finances, employment and household wealth creation

- Public finances must be put on a sustainable footing and economic growth accelerated to safeguard welfare and national security. Taxation must incentivise work and longer careers.

- Securing the funding of the welfare society will also require greater individual responsibility and financial preparedness.

- The modern financial sector’s significance and attractiveness as an employer must be reinforced. The evolving sector needs highly skilled employees.

3. Preparedness and responsibility – Promoting cybersecurity, responsible use of artificial intelligence and the carbon-free transition

- Growing geopolitical tensions have markedly increased the importance of security of supply and cybersecurity. Financial sector actors are key targets of hybrid influence, and their customers are frequently exposed to digital fraud attempts. The sector’s success is greatly influenced by the advantages of generative AI and the efficient utilisation of data.

- It is necessary to develop more responsible green investments and investment products, as climate change and biodiversity loss increase financing and insurance risks.

- We seek to strengthen society’s resilience. Finance Finland highlights the sector’s essential role in fortifying comprehensive security also to enhance the sector’s reputation.

- Skilled and motivated personnel are Finance Finland’s greatest asset.

Forces of change in the operating environment that require special strategic focus

The Better Regulation agenda

- The growing volume of regulation raises costs and administrative burden, impairs flexibility and slows down decision-making. It can also weaken the global competitiveness of European companies and reduce their capacity for investment and innovation.

- The streamlining of regulation is one of the European Commission’s goals, but the likelihood and shape of its implementation remain unclear. Uncertainty in the regulatory environment makes future forecasting increasingly challenging. Now is a very opportune moment to promote simpler regulation.

Digital fraud and scam attempts

- Technological development gives rise to new methods of increasingly convincing digital fraud and scams that target all levels of society.

- Financial sector actors are key targets of hybrid influence, and their customers are frequently exposed to digital fraud attempts. The importance of cybersecurity is growing. There is a pronounced need to promote awareness and knowledge at the individual level, as well as preparedness and investments in cybersecurity at organisational and state levels.

Security and preparedness

- Global geopolitical turmoil will reshape Europe’s security and defence needs in the coming years. At the same time, climate change and biodiversity loss are increasing the risks of finance and insurance. Investment in and new approaches to preparedness are sorely needed. The coming years will be characterised by crisis preparedness on many fronts. Sustainability and resilience will be needed by companies, communities and society. The financial sector must be involved in enabling and making investments in security and in maintaining a functional society.

Development of artificial intelligence, data economy and technology

- Artificial intelligence is widely used in the finance and insurance sector. Its positive impact on various tasks and business operations is considered significant. In the coming years, AI is expected to have pronounced impact on productivity, quality of work and operational monitoring. The significance of data use regulation will increase, and AI and data use will rise even higher in lobbying priorities. The rapid pace of change will bring forth many challenges. The use of AI must be responsible and transparent across the sector.

WORKPLACE VALUES

We work together and help each other

- We all bear responsibility for the workplace atmosphere.

- We know we can reach our goals only by working together.

- We meet the agreed deadlines without sacrificing quality.

- We encourage each other and give positive feedback for a job well done. We are also open to criticism.

- We appreciate that we are all experts in our own field.

We break new ground

- We keep an open mind and engage in dialogue also with critical voices.

- We seek to learn and share what we have learned.

- We anticipate future developments together and are ready to stand as an example.

- We boldly adopt new working practices and let go of the old.

- We eagerly look for solutions instead of new problems to solve.

We are responsible

- We consider the impact of our work across the board.

- We think with a long-term perspective.

- We present our views openly, neither exaggerating nor downplaying their importance.

- We ensure our information is reliable. We will also admit if we do not know something.

- We look after our own wellbeing at work but also care for the wellbeing of our colleagues.

Looking for more?

Other articles on the topic

More secure day-to-day life and a wealthier future ‒ Fraud prevention and promotion of retail saving and investing are key priorities in Finance Finland’s lobbying

New recommendations for good lobbying practice promote a responsible lobbying culture in Finland – Finance Finland is committed to the ethical guidelines

Finance Finland is committed to open lobbying – The 2023 transparency report covers lobbying activities in Finland and Brussels

Home is where the EU is – it’s time to roll up our sleeves and solidify our place at the heart of the Union