- According to the latest insurance survey, Finns now have fewer voluntary insurance policies than before.

- The declining trend applies to home insurance, accident insurance, life insurance and car insurance. The popularity of medical expenses insurance has remained unchanged, the survey shows.

- According to expert opinion, the trend may be linked to the tighter economic situation. Cutting back on insurance can, however, prove costly if cover is insufficient when something goes wrong.

The results are from Finance Finland’s 2025 Insurance Survey. The survey is part of a follow-up study that has been conducted regularly since 2000 to survey Finns’ opinions of insurance companies and products. The previous survey was conducted in 2022.

Home insurance continues to be the most popular voluntary insurance among Finns. According to Finance Finland’s 2025 Insurance Survey, 84% of Finns have home insurance. In 2022, the figure stood at 88%. Past survey results reveal that home insurance has been showing a declining trend since the peak year 2014, when 95% of respondents had home insurance.

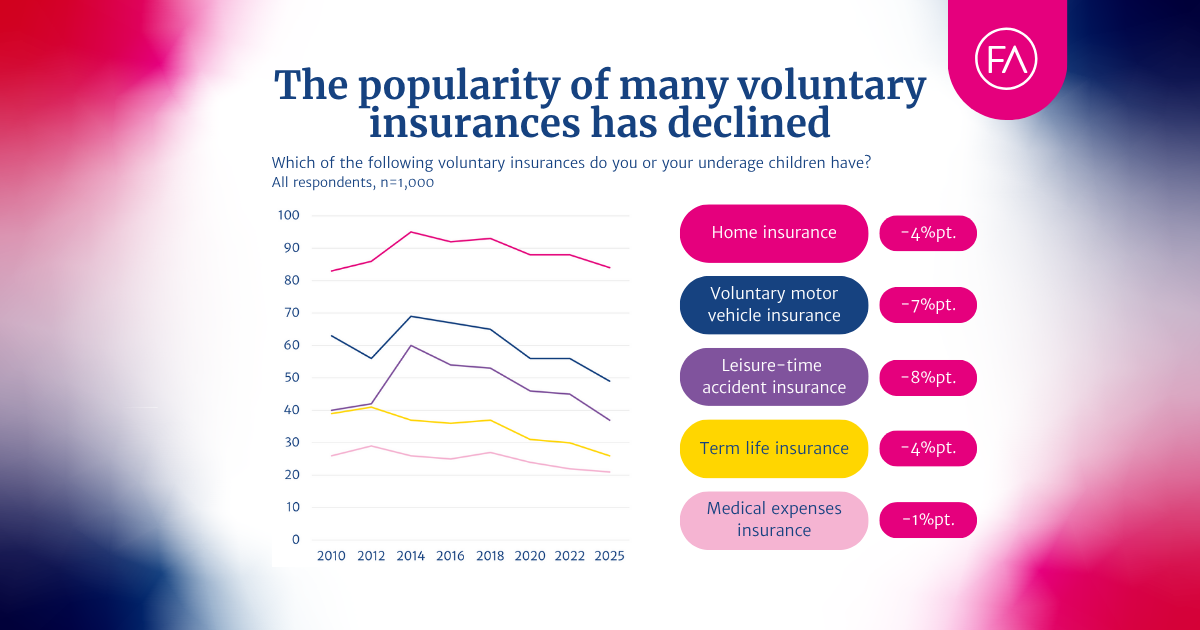

The popularity of many voluntary insurance policies has declined noticeably from the previous survey conducted in 2022:

- Home insurance 84% (88% in 2022)

- Motor vehicle insurance 49% (56%)

- Leisure-time accident insurance 37% (45%)

- Life insurance 26% (30%)

The 2025 survey results show that 21% of Finns have voluntary medical expenses insurance. In the previous survey, the figure was 22%. Statistics on medical expenses insurance collected by Finance Finland from insurance companies back these figures. Similar statistics are not available for other voluntary insurance products.

The survey also looked at Finns’ risk awareness, asking respondents to weigh a number of risks in terms of how much they these would threaten their personal or their family’s financial wellbeing. The results showed no major changes in risk awareness, so the lower number of voluntary insurance policies is not explained by changes in experienced risks.

“The economic situation has been difficult these past years, which may help explain the trend. When personal finances are tight, insurance premiums are often one of the first expenses to be cut”, analyses Hannu Ijäs, director of legislation at Finance Finland.

“Part of the decline in the popularity of home insurance may be explained by the rise in rental housing. Landlords do not always insist on tenants having home insurance, even though it would definitely be in their best interests. Meanwhile, ongoing debate about the challenges in public healthcare may help explain why the popularity of medical expenses insurance has not dropped”, Ijäs says.

Studies conducted by the Consumers’ Union of Finland have identified a clear shift in Finns’ financial situation: “In 2022, one in five Finns reported that their monthly budget could not absorb any price increases without it causing financial strain. That figure has now risen to one in four. People are being forced to cut back on everything, even on medicines”, says Juha Beurling-Pomoell, secretary general of the Consumers’ Union of Finland.

Economising on voluntary insurance can prove costly in the long run

According to Finance Finland’s Hannu Ijäs, cutting back on voluntary insurance is not a decision that should be taken lightly or without weighing how much risk you are willing to tolerate.

“If money is tight, it may be tempting to save on insurance premiums. But this can prove much more expensive in the long run if an accident or damage occurs and you need the coverage. My advice is to carefully consider your own risk tolerance: could your finances really withstand the type of loss you’re thinking of giving up coverage for?” Ijäs says.

“If you must cut back on something, increasing the insurance deductible could be an option. This means you would pay a larger portion out of pocket if something happens, but it significantly lowers the premium and you still have protection against major losses”, Ijäs advises.

In the case of home insurance, for example, potential losses from damage can be financially significant. In the event of a fire or water damage, losses can easily amount to tens of thousands of euros – or even more. In apartment buildings, water damage can also result in liability for damage caused to neighbouring homes.

“If your personal finances could not absorb the losses, giving up insurance is extremely risky”, Ijäs explains. “For many Finns, the financial impact of damage to a car is likely to be smaller than the fire or water damage typically covered by home insurance. Even so, it’s worth considering how important your car is for you, for example for getting to work. If your car is damaged in a traffic accident, can you afford the repairs? And if not, can you manage without a car? This kind of reasoning should be applied to every type of insurance”, says Ijäs.

In addition to the decline in the number of life insurance policies, there is evidence that even those Finns who do have life insurance tend to insure themselves for too low an amount in the event of death. ETLA Economic Research published a report on the life insurance gap in Finland in the spring of 2022. At the time, ETLA calculated the life insurance gap arising from the death of a breadwinner in families consisting of at least two persons to be between €65,000 and €70,000.

Finance Finland’s 2025 Insurance Survey was conducted by Norstat Finland in the Norstatpanel online survey panel. The data was collected between 30 April and 12 May 2025 from a sample of about 1,000 Finns.

Looking for more?

Other articles on the topic

2025 Insurance Survey: Finns have fewer voluntary insurance policies than before

Finns are happy with their insurances – 86% consider compensations proportionate to the suffered loss, and claims are rarely rejected

Customers are already protected if an insurance company fails – An EU-wide insurance guarantee scheme is not needed

Financial sector’s VAT treatment needs an overhaul, but the Finnish pension system must not be hampered with added tax burden