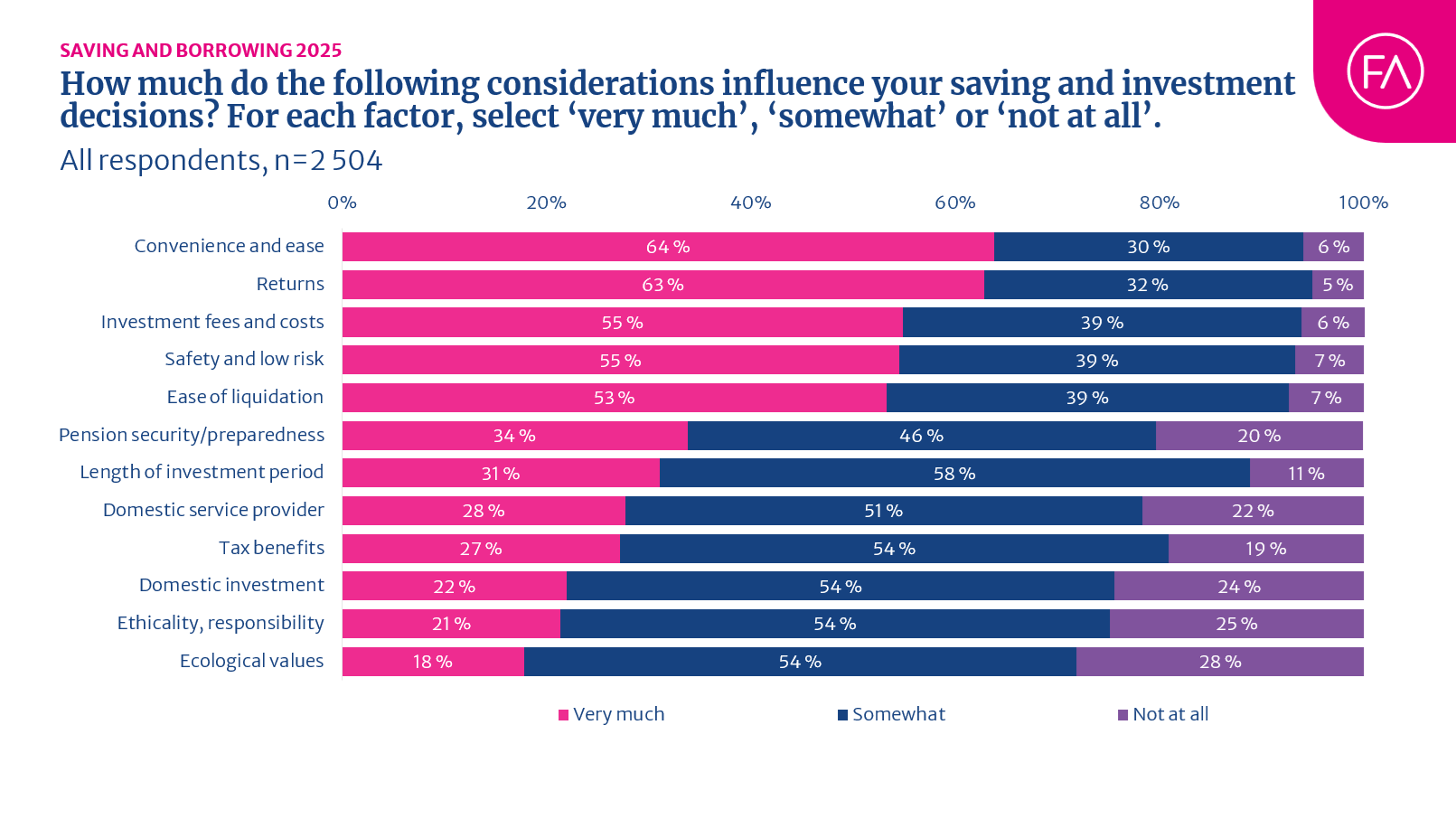

- When choosing between investment options, Finns value convenience and strong returns above other considerations.

- In Finance Finland’s latest saving and borrowing survey, 64% of the respondents said convenience was a decisive factor when they were choosing their investments. Returns were very important in the investment decisions of 63%.

- The least importance was given to ethics and responsibility and the ecological and environmental aspects of the investment.

Finance Finland has surveyed Finnish households’ use of money with an interval of one to two years since 1979. Saving, borrowing and payments were previously grouped in a single survey, but the saving and borrowing section was separated into its own survey in 2022. The survey’s target group consists of people aged 15–79 living in mainland Finland. This year, the survey interviewed 2,504 target group members. The survey was conducted by Norstat Oy in May–June 2025.

Convenience and return on investment are the most important factors when Finnish retail investors decide what they invest in, reveals the latest saving and borrowing survey commissioned by Finance Finland. Of all respondents, 64% said convenience had a major influence on their investment decisions, and 30% said it had a moderate influence.

“Good examples of convenient investment products include investment-linked insurance and funds. They offer an easy way to invest without having to monitor stock market fluctuations or make portfolio adjustments yourself. They also don’t require a large initial sum: funds enable diversified investment even with a small amount of money, and Finnish funds’ fees are well below the EU average”, says Jari Virta, head of asset and fund management at Finance Finland.

Return on investment was considered very important by 63% of the respondents when choosing what to save or invest in. This result is the same as in the previous survey two years ago, but in the older surveys, only about 40% of the respondents said return was among the decisive factors in their investing.

“I’m pleased to see that returns are now a key consideration for investors. In the past, investors have tended to focus too much on seeking safety and hedging against inflation. Controlled and diversified risk-taking is essential for achieving returns and profit”, Virta notes.

Headwinds in sustainability and responsibility

The sustainability of the investment had the least impact on respondents’ investment decisions. Only 21% considered ethics and responsibility very important, and only 18% emphasised the importance of taking ecological and environmental values into account. Both figures have maintained a declining trend from one survey to the next.

Finance Finland’s Head of Public Affairs and Responsibility Pirita Ruokonen believes that the prevention of climate change and biodiversity loss has been overshadowed by geopolitical tensions and other pressing issues.

“This is, of course, very short-sighted, as the environmental and climate crisis will not wait for wars and economic depression to end. Nevertheless, the Finnish financial sector continues its work to ensure that sustainable and responsible investment will remain accessible, convenient and attractive in the future.”

Still have questions?

|Contact our experts

Looking for more?

Other articles on the topic

Saving and borrowing survey: Finnish investors value convenience and returns

The Nordic model for European savings and investments accounts is simply excellent – The Commission would be wise to look to the North

Commission unveils proposal to revive securitisation, aiming to strengthen EU capital markets

Investment should be encouraged with effective solutions, not regulation – The European savings and investments account would draw on member states’ best practices