Facebook is full of very handsome and beautiful new ‘friends’ who are quickly in need of a ‘loan’. Online marketplace sellers receive links asking to ‘accept incoming payment’. Instagram features a well-known politician advertising a unique investment opportunity that has previously been kept a secret from the public. These are only a few examples of various types of fraud designed to give criminals access to our money.

Fraud targeted at bank customers has increased by the year, and fraudsters keep coming up with new methods to trick bank customers online. According to a UK report, in 2022 a total of 96% of fraud and scam attempts originated either from online sources or from phone calls and text messages. The British fintech company Revolut has estimated that 60% of all fraud cases originate on Meta platforms such as Facebook, Instagram and WhatsApp and have to do with product scams or fraudulent advertisements.

As soon as one method of fraud is tackled through technical solutions or customer awareness campaigns, new ones crop up in its place. According to the police, fraud has already surpassed drug-related crime in both lucrativeness and popularity among criminals – after all, fraud is tidy white-collar crime that involves a low risk of the top brass getting caught. Fraudsters can afford to pay search engine operators to put fake bank websites at the top of the search results or advertise enticing offers on social media platforms, getting people to walk right into their trap.

======

As soon as one method of fraud is tackled

through technical solutions or

customer awareness campaigns,

new ones crop up in its place.

======

Fraud prevention is an international effort that requires collaboration between the police, banks and international partners. Fraud should be tackled at the source, whether it originates from a text message, an email or a social media platform. This is why fraud prevention liability must be extended also to the service providers of the channels through which fraudsters approach their victims in the first place.

Although the majority of fraud originates from online sources or telecommunications, the responsibility for preventing fraud and reimbursing the financial losses of victims has been put entirely on the banking sector. Electronic communication service providers should be held to higher standards and made legally liable to prevent fraudulent activities.

Cooperation between communication service providers and the banking sector has typically worked well when preventing things like terrorist activity or drug trade. But when prevention measures should be extended to paid advertising on the online platforms typically used by fraudsters, the same service providers are much less eager to collaborate. They are unwilling to monitor, screen and delete paid ads, links or search results that lead to fake websites –which is no wonder because fraudsters pay them to show these to people.

Banks are constantly developing their fraud detection and customer education and awareness. The majority of fraud is stopped before the first payment ever takes place. Many fraudulent payments are intercepted or returned to the victim. The problem is that it is impossible for banks to unequivocally identify all fraudulent transactions from the millions of transactions that go through them. This means that banks have to introduce friction by asking their customers for authentication or other extra steps.

======

Banks are at the forefront of tackling fraud,

but they cannot solve the problem alone.

======

The EU wanting to make payments even faster is not making matters any easier. As of autumn 2025, all banks must be able to send instant payments that make funds available in the payee’s account within ten seconds. Instant payments are an alluring opportunity for criminals because they leave no time for customers or banks to act. We are already seeing that the share of fraudulent transactions is nine times higher in instant payments than in regular credit transfers.

Banks have been left to shoulder the fraud prevention duty more or less on their own even though many other operators in the chain could also affect whether fraud attempts are successful or not. If the goal is to really root out digital fraud, these other operators should also be made liable. Banks are at the forefront of tackling fraud, but they cannot solve the problem alone.

Still have questions?

|Contact the columnist

Looking for more?

Other articles on the topic

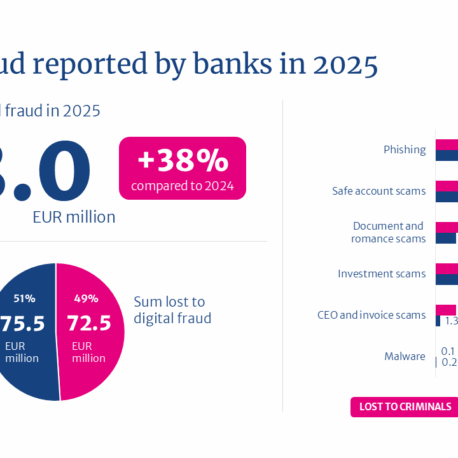

Total value of attempted digital fraud climbed to €148 million in 2025, but banks successfully intercepted more than half of the payments

Even a prolonged service disruption will not stop in-store payments – Finance Finland publishes report on the resilience of card-based payments

Banks and operators crack down on scam sites – new anti-fraud model enables faster response times

Fraudsters have months to hook their victims – banks must prevent fraud in seconds