- According to the Finnish Financial Supervisory Authority’s (FIN-FSA) thematic review, all large and medium-sized Finnish financial sector companies that responded to the survey reported either already using or intending to start using AI in the next two years.

- AI-powered chatbots and virtual assistants allow for faster and more efficient customer interactions.

- AI solutions to analyse customer data help gain a more detailed understanding of customer needs and behaviour, which helps create more tailored services and improve customer satisfaction.

- Financial sector companies also use AI to fight financial crime – for example to prevent money laundering and terrorist financing, monitor compliance with international sanctions regulations and detect and prevent fraud.

- Financial sector companies have already widely adopted their own ethical AI standards, AI strategies and AI user rules. The use of AI systems is also governed by EU regulation and supervision. As market supervisor, the FIN-FSA must be granted sufficient resources to carry out its supervisory duties.

The FIN-FSA’s survey covered 83 companies: 22 insurance companies, 10 Finnish banks, 20 Finnish branches of foreign banks, 11 companies operating in the financial sector (investment firms, fund management companies, the stock exchange and the central securities depository), 7 payment service providers and 13 consumer lenders. It was conducted in February 2025.

The Finnish Financial Supervisory Authority (FIN-FSA) published its thematic review on the use of artificial intelligence (AI) in the financial sector in June 2025. AI is no newcomer to the sector: it has long been used to streamline various background processes, but with the recent rapid technological advances, the uses of AI solutions have increased and expanded.

“The report is important for the financial sector because the FIN-FSA is the market supervision authority for high-risk AI systems in the sector. The report offers a helpful overview of how financial companies use AI”, says Finance Finland’s Legal Adviser Tuulia Karvinen.

According to the report, companies typically use AI in translation, information search and summarising, generation of textual content, software coding and systems development. AI is used to improve internal processes but increasingly also to enhance customer experience. AI-powered chatbots and virtual assistants make customer journeys smoother as automated customer service allows customers to handle their matters whenever they want.

Another key AI use case is the analysis of customer data. AI solutions help gain a better and more detailed understanding of customer needs, allowing companies to offer their customers more tailored services and thus improve their customer satisfaction.

Financial sector companies also use AI to fight financial crime – for example to prevent money laundering and terrorist financing, monitor compliance with international sanctions regulations and detect and prevent fraud.

FIN-FSA must be guaranteed sufficient resources to supervise the use of AI

The use of AI systems involves obligations and supervision to ensure that they are used safely and responsibly. According to the FIN-FSA survey, financial sector companies had widely adopted guidelines on the use of AI: 82% of the respondents reported that they have AI user rules and 51% that they had an AI strategy outlining the role and objectives of AI in their organisation.

“The report shows that financial sector companies are using AI responsibly and have taken the initiative to create their own rules on its use. Recent regulation will hopefully offer a clearer, well-functioning framework for the use and further development of AI systems”, says Karvinen.

The FIN-FSA supervises the use of AI as part of its broader supervisory duties. As the financial sector’s market supervision authority, its purpose is to ensure that companies use AI according to rules and regulations and are aware of their responsibilities.

Karvinen’s message to the powers in charge of the FIN-FSA’s resources and budget is unequivocal: “The FIN-FSA must be guaranteed sufficient resources and competencies to effectively supervise compliance with regulatory requirements.”

Still have questions?

|Contact our experts

Looking for more?

Other articles on the topic

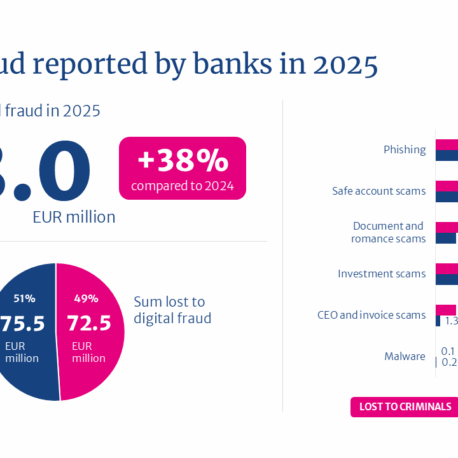

Total value of attempted digital fraud climbed to €148 million in 2025, but banks successfully intercepted more than half of the payments

Even a prolonged service disruption will not stop in-store payments – Finance Finland publishes report on the resilience of card-based payments

Cash is about more than just ATMs and shops – how can we secure Finland’s cash supply?

FIN-FSA surveyed financial sector companies’ use of AI – from crunching data to fighting financial crime