- Finance Finland has published its overviews of banks’ and insurers’ performance and operating environment in 2024.

- The banking sector remained stable and operational despite economic fluctuation.

- Banks’ good profitability and capital position strengthened their resilience against risks.

- The insurance sector had a good, if uneventful year.

- Insurers’ investments generated good returns, but pension benefits and claims grew stronger than premium income.

Finnish banking is an annual overview on the Finnish banking sector, its structure and its operating environment. Finnish insurance is a financial overview examining Finnish insurance companies’ performance and key figures. Both are published by Finance Finland once a year. Key figures and links to the full reports are included at the end of this article.

Banks were protected by their good profitability and strong capital position even as the economy continued to weaken both globally and in Finland.

“Throughout the year, banks were – and still are – in a good position to withstand the effects of economic downturn. The good profitability and capital position of Finnish banks protects them from risks associated with funding, liquidity and customer creditworthiness”, says Finance Finland’s Adviser Jussi Kettunen, author of the Finnish banking report.

One of the few positive sides of the upended geopolitical situation is that it has helped accelerate the green transition, the effects of which are also visible in the banking sector. According to the Finnish Meteorological Institute, 2024 was the hottest year on record. The EU aims to make Europe the world’s first climate-neutral continent by 2050, and Finland’s goal is to become a carbon-neutral country by 2035.

“The banking and insurance sectors play a key role in this transition as the providers of funding and protection against business risks. It’s important that banks can finance not only projects that are already labelled green but also companies that are making the transition towards carbon-neutrality”, Kettunen says.

Uneventful year for insurers

Insurers’ aggregate premiums written increased 5.2% to a total of €29.8 billion. In the investment market, the year was a successful one: at the year-end, the aggregate market value of insurers’ investments was €194 billion and the total net return on the investments 8.7%.

“The year can be considered uneventful, even somewhat boring, which is a very good thing in an industry like the insurance sector”, comments Finance Finland’s Analyst Kimmo Koivisto, author of the Finnish insurance report.

Insurance companies’ results were pulled down by strong growth in pension benefits and claims incurred, which overshadowed the growth of premium income. Claims and pension benefits were paid out for a total of €29.2 billion, which represents a growth of 5.4% from the previous year.

Life insurance premiums grew by as much as 20%. According to Koivisto, much of this increase can be attributed to the successful sales of insurance products and new products entering the market.

Claims paid under non-life insurance totalled €4.3 billion, increasing by almost 10% from the previous year.

“Road weather conditions were very difficult in the early months of the year, which resulted in a considerable amount of claims. The number of major losses valued at €200,000 or more was also higher than usual”, Koivisto says.

Authorised pension insurance providers’ investments were very successful. The overall performance of their investments was 9.2% calculated on current values, and the aggregate value of the investments increased to a total of €161 billion.

Life and non-life insurers maintained strong solvency positions despite clear weakening. Pension insures’ solvency position was also at a good level.

Volume of housing construction continued to drop

Towards the end of 2022, Finland’s long-term trend of active construction took a downward turn. The downslope only deepened in 2024, which saw fewer than 20,000 building starts. According to the VTT Technical Research Centre of Finland, the average long-term housing production need is up to 35,000 dwellings per year.

The real estate sector’s stability is important for banks: about 60% of all household and corporate loans granted by Finnish banks are housing loans and other mortgage-backed loans.

“Sufficient new construction is a prerequisite for maintaining the balance between supply and demand and ensuring steady price development. An unstable real estate sector and strong fluctuation in housing prices can also affect banks as the providers of financing”, Kettunen points out.

Slight growth in employee numbers

In 2024, the average number of persons employed by Finnish insurance companies was 10,847, which is over 300 employees more than the year before. Nearly all of the largest insurance companies increased their number of employees. Finnish banking groups and foreign deposit-taking banks’ Finnish branches employed a total of 21,622 people at the end of the year. This is over 500 employees more than in the previous year.

If group structures are ignored, there were 177 credit institutions operating in Finland at the end of the year. This is 8 fewer than at the end of 2023, mainly due to mergers within banking groups. At the end of 2024, there were 46 licensed Finnish insurers in Finland: 34 specialising in non-life business and reinsurance, 8 in life insurance and 4 in statutory employee pension insurance.

Insurance sector key figures 2024

- Insurance premiums written in Finland increased by 5% to a total of €29.8 billion.

- Return on investments was 9%.

- Life insurers’ premium income grew by 20%, totalling €5.5 billion.

- Non-life insurers’ premium income increased by 3% to €5.6 billion.

- Premiums written in statutory employee pension insurance grew by 2% to €18.8 billion.

- Claims and pension benefits were paid out for €29.2 billion. This represents a growth of 5% from the previous year.

Banking sector key figures 2024

- The banking sector’s common equity tier 1 (CET1) capital ratio was 18.2% (18.3% in 2023) and total capital ratio 22.2% (22.1%).

- The Finnish banking sector’s return on equity (ROE) stood at 13.9% at the end of the year (13.9%).

- The banking sector’s profit increased by 8% from the previous year, totalling about €9.9 billion.

Still have questions?

|Contact our experts

Looking for more?

Other articles on the topic

Saving and borrowing survey: Finnish investors value convenience and returns

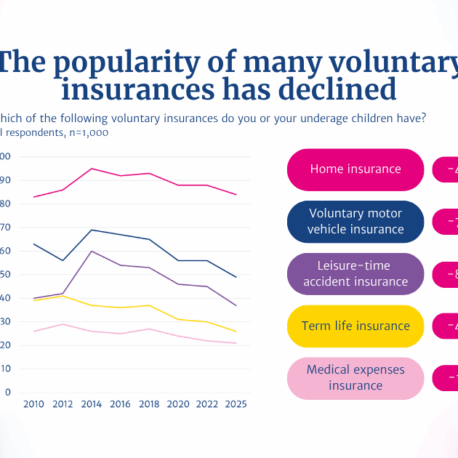

2025 Insurance Survey: Finns have fewer voluntary insurance policies than before

Finns are happy with their insurances – 86% consider compensations proportionate to the suffered loss, and claims are rarely rejected

Finnish banks’ and insurers’ performance and operating environment in 2024: Banking sector remained stable, insurers had an uneventful year