- The Savings Starter for Children would make investing a comfortable routine from an early age.

- Finance Finland’s proposed model for a Savings Starter for Children would enable many more children and families to start investing, creating personal wealth and improving their financial literacy.

- In its programme, Prime Minister Petteri Orpo’s government committed to exploring the possibility of creating an equity savings account for newborns, an initiative raised by the previous government.

- Finance Finland encourages the government to consider the Savings Starter for Children as a way of implementing the government programme.

“Saving and investing should be a routine part of life for all Finns, just like regular exercise and a healthy lifestyle. We should encourage the habit from an early age”, says Finance Finland’s CEO Arno Ahosniemi.

Finance Finland’s proposed solution is called the Savings Starter for Children. The model would enable the Government to implement its commitment to explore the possibility of creating an equity savings account for newborns, as recorded in the government programme. The State would grant each newborn Finnish child an initial investment in the account as part of the maternity package. The idea was raised already in the previous term of government, when the Ministry of Employment and the Economy set up a working group for promoting the culture of ownership in Finland.

“The aim of the Savings Starter for Children is to mainstream systematic long-term investments from a young age. This would also strengthen Finns’ financial literacy”, explains Legal Adviser Aurora Idänpää, one of the model’s developers at Finance Finland.

Main outline of the Savings Starter for Children

- Initial capital granted by the State, for example €300 per newborn.

- A wide range of investment options ranging from shares and equities to funds, securities and investment policies.

- Invested capital and its returns cannot be withdrawn from the Savings Starter before the child turns 18.

- Capital and its returns are not taxed until they are withdrawn.

- Additional investments into the Savings Starter must be subject to the same tax treatment as the initial capital.

- The Savings Starter of a child under 18 does not affect the family’s social security benefits.

Although more and more Finns have started to invest in recent years, the majority still do not have investments, forgoing a key opportunity for personal wealth accumulation. In fact, Finns’ attitudes towards ownership and wealth creation in general are verging on sceptical, even oppositional. Compared to our Nordic peers, Finns are lagging behind: the ratio of private investment to GDP in Finland is only half of that of Sweden or Denmark.

“The Savings Starter for Children would help dispel suspicions regarding investing and encourage Finns to create personal wealth already from an early age”, Ahosniemi says.

The Savings Starter model includes an initial capital of a few hundred euros granted by the State, which the parents can apply for at the same time as they apply for the child benefit.

“The initial capital offers a good inventive to take up the Savings Starter also for families that are not so familiar with investing . This promotes ownership and wealth creation at grass-roots level. When the array of products is not limited to equities, the starting threshold is lower, diversification of risk is easier and additional investments of all sizes are more feasible”, says Ahosniemi.

One of the key ideas of the Savings Starter for Children is that the child’s relatives can deposit cash gifts such as birthday money directly into the child’s savings account, where they will continue to accumulate compound interest over the years.

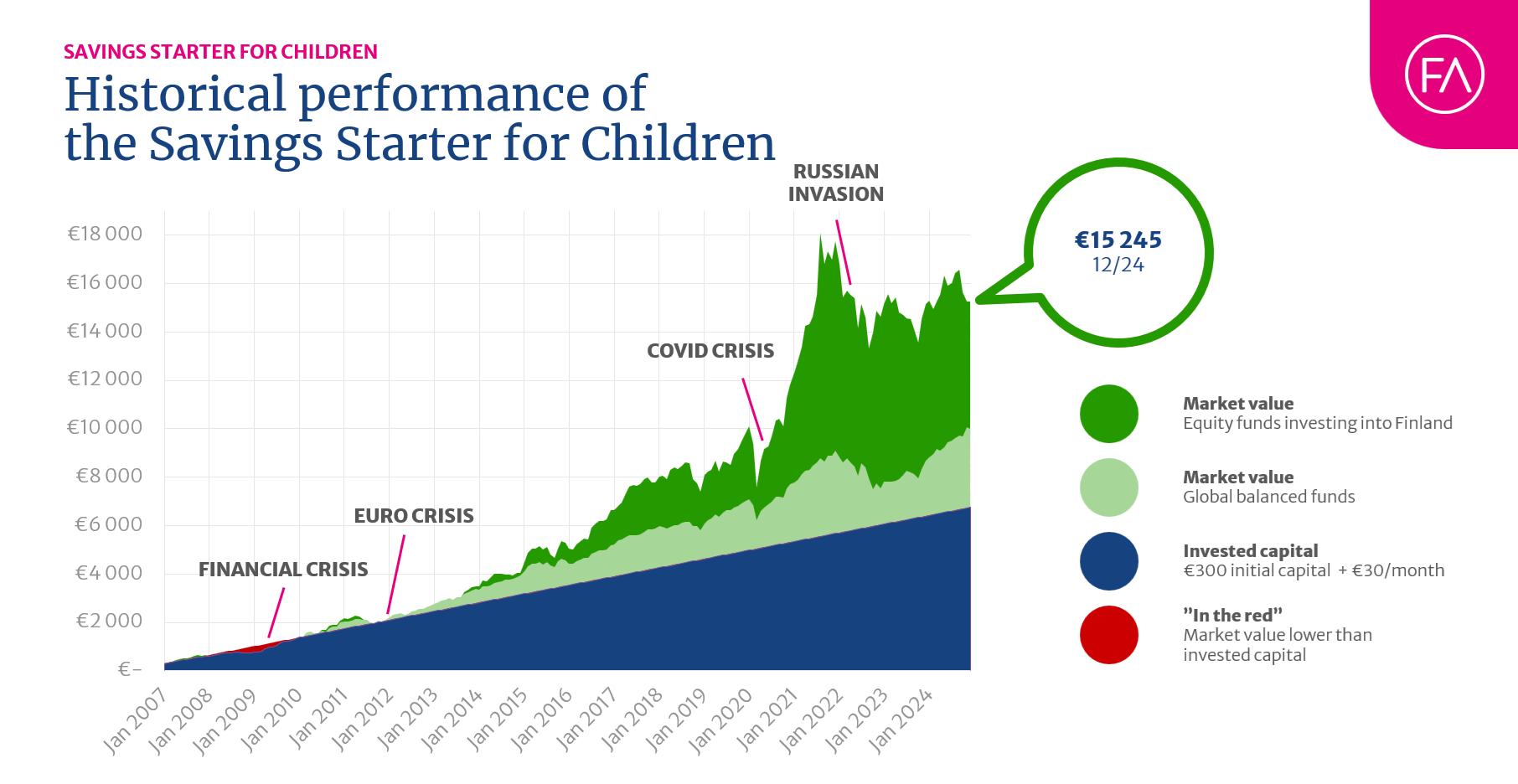

“An initial capital of €300 is enough to generate a good profit on its own. But, as our graph shows, a modest additional investment of €30 per month can increase the market value of the savings account to thousands of euros by the time the child turns 18”, Idänpää points out.

Still have questions?

|Contact our experts

Looking for more?

Other articles on the topic

Saving and borrowing survey: Finnish investors value convenience and returns

The Nordic model for European savings and investments accounts is simply excellent – The Commission would be wise to look to the North

Commission unveils proposal to revive securitisation, aiming to strengthen EU capital markets

Investment should be encouraged with effective solutions, not regulation – The European savings and investments account would draw on member states’ best practices