- There is no need to establish EU-wide arrangements for insurer insolvency.

- In Finland, statutory insurance is already covered by an extensive joint guarantee system ensuring that if an insurer fails, policyholders get full compensation. Policyholder claims have first priority in the event of an insurer’s insolvency also in non-statutory classes of insurance.

- The Insurance Recovery and Resolution Directive (IRRD) requires the European Commission to assess the appropriateness of minimum common standards for insurance guarantee schemes in the EU.

- The purpose is to assess whether there is a need to enact EU legislation on national insurance guarantee schemes or even establish a single EU-wide insurance guarantee scheme.

- The insurance sector does not have a similar risk of contagion as the banking sector.

- However, many EU countries have highly concentrated insurance markets, which means that funding an insolvent insurer could increase the risk of problems spreading to other insurers.

- The IRRD and the Solvency II directive already make insurer insolvency highly unlikely.

An insurance guarantee scheme is a system ensuring that if an insurer fails, other insurers step in to compensate policyholders for their losses. Finland has effectively addressed the need for and scope of a national insurance guarantee scheme with a joint guarantee payment system of insurers that covers statutory non-life insurance. There is no obvious need to establish an EU-wide insurance guarantee scheme or a European network of harmonised national insurance guarantee schemes.

“Legislators have been considering the EU-level harmonisation of national insurance guarantee schemes for almost two decades now, but member states have overturned all plans. In the EU, insurance markets are largely national, leading to great national differences in insurance. A good example of a line of insurance with great variation is workers’ compensation insurance”, says Hannu Ijäs, director of legislation at Finance Finland.

In Finland, the policyholders and other beneficiaries of statutory insurance are guaranteed to receive full compensation in the event of an insurer’s insolvency. This also applies to statutory insurance granted by foreign insurers. In voluntary non-life insurance, injured parties also take priority over other claimants.

The Insurance Recovery and Resolution Directive (IRRD) requires the European Commission to assess the appropriateness of minimum common standards for insurance guarantee schemes in the EU. The purpose is to assess whether there is a need to enact EU legislation on national insurance guarantee schemes or even establish a single EU-wide insurance guarantee scheme.

Ijäs points out that different member states have very different insurance products. Especially in personal insurance policies, differences between member states in both social security cover and taxation have led to different insurance cover needs and thereby to different products. This makes the establishment of a European insurance guarantee scheme not only very difficult but also highly inefficient.

“Unlike in banking, in insurance it is unlikely that the failure of an insurer would lead to problems spreading in a bank run style to other insurers. However, many EU countries have highly concentrated insurance markets, which means that funding an insolvent insurer could increase the risk of problems spreading to other insurers.”

Moreover, current regulation already protects insurance policyholders. The IRRD and Solvency II directives and the high ranking of policyholder claims in the creditor hierarchy already work to effectively minimise the likelihood of insolvency and its effects on the compensation paid to policyholders and beneficiaries.

Still have questions?

|Contact our experts

Looking for more?

Other articles on the topic

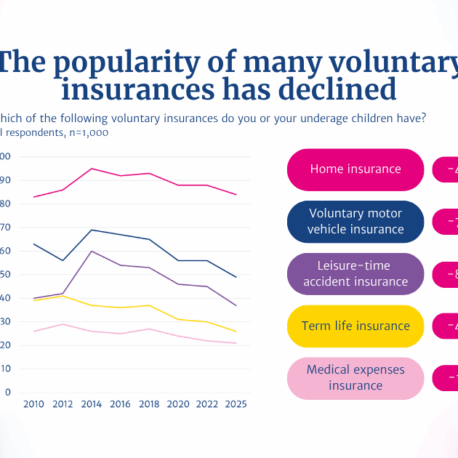

2025 Insurance Survey: Finns have fewer voluntary insurance policies than before

Finns are happy with their insurances – 86% consider compensations proportionate to the suffered loss, and claims are rarely rejected

Customers are already protected if an insurance company fails – An EU-wide insurance guarantee scheme is not needed

Financial sector’s VAT treatment needs an overhaul, but the Finnish pension system must not be hampered with added tax burden