The financial sector is one of

Finland’s major taxpayers

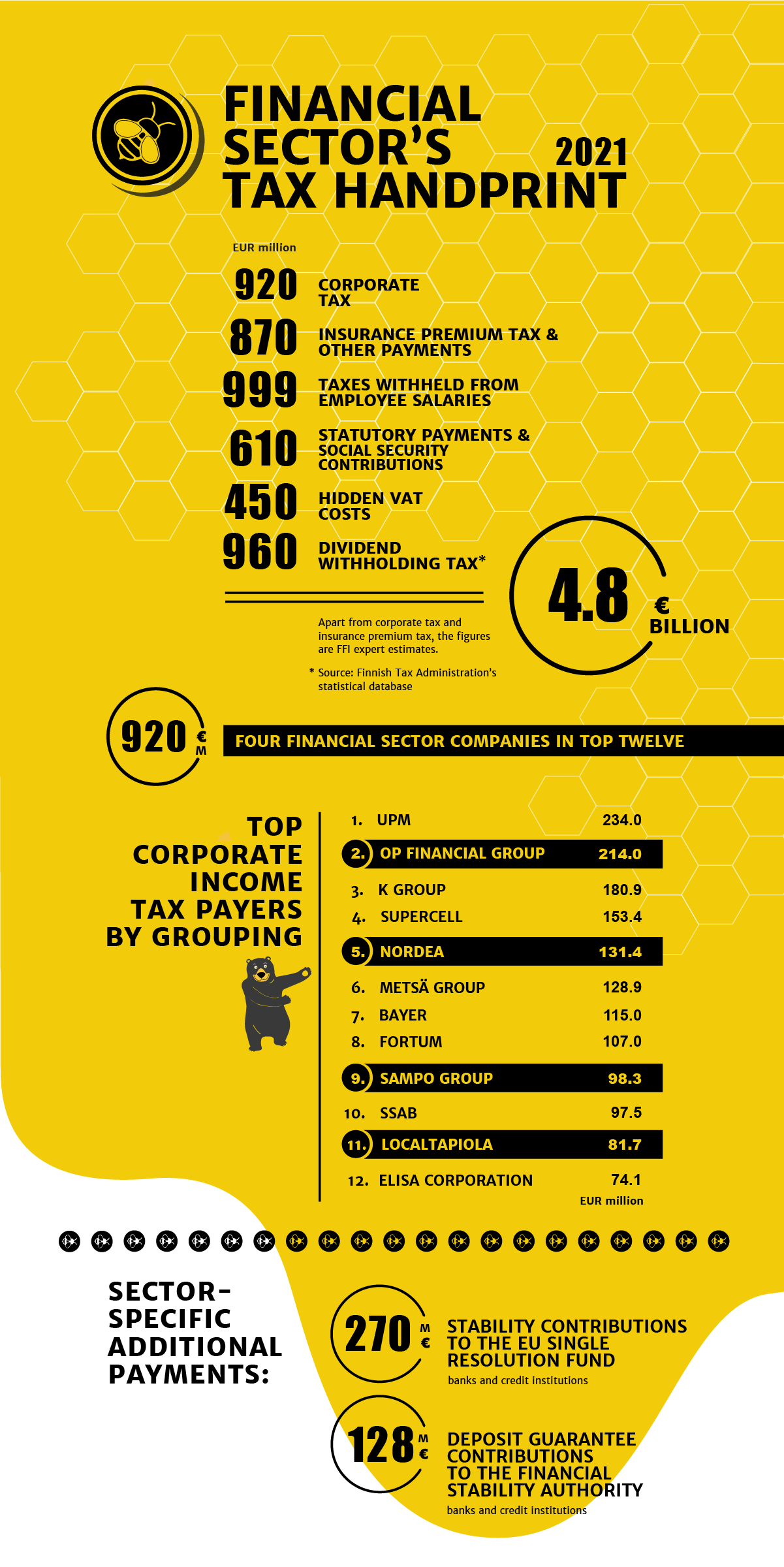

- The Finnish financial sector’s tax handprint totalled 4.8 billion euros in 2021. This is equal to the three-year budget of the country’s child benefits.

- The financial sector’s tax handprint includes corporate income tax (€920 million), insurance premium tax (€848 million) and contributions towards fire protection, road safety and industrial safety (€22 million). Moreover, the sector generates employee income tax (€999 million), social security contributions (€610 million) and dividend withholding tax (€960 million) and pays hidden VAT costs of €450 million.

- The financial sector’s €920 million constitutes more than 12% of all corporate income tax paid in Finland.

- The top payers of corporate income tax included several financial sector companies: OP Financial Group (2nd place), Nordea (5th place), Sampo Group (9th place) and LocalTapiola (11th).

The financial sector was once again one of the biggest taxpayers in Finland according to 2021 tax data released by the Tax Administration. In total, the sector paid €920 million in corporate tax, which amounts to more than 12% of all corporate tax in Finland and is about €357 million more than in 2020. The top twelve payers of corporate tax included four financial sector companies: OP Financial Group, Nordea, Sampo Group and LocalTapiola Group.

“Our member companies’ top positions in the tax statistics are a good reminder that banks and insurers have long been among the biggest taxpayers and financiers of the Finnish welfare society. But taxation has its limits. The financial sector’s ability to provide financing, insurance and investment options to households and businesses will be at risk if the sector is burdened with new taxes. Sector-specific taxes, for example, would weaken the Finnish sector’s competitiveness and raise costs for customers”, emphasises Piia-Noora Kauppi, managing director at Finance Finland.

Hidden VAT costs estimated to reach €450 million

In accordance with the EU VAT directive, financing and insurance services are exempt from value added tax. This exemption is based on difficulties in defining the tax base, problems with technical implementation and reasons of international competition.

Unlike most companies, financial sector companies cannot deduct the VAT for the goods and services they purchase. The sector thus bears a hidden VAT burden compared to companies that sell services which are subject to VAT. Finance Finland estimated in 2020 that this VAT amounted to approximately €450 million. This estimate is valid also in 2021.

“The non-deductible VAT raises prices especially to corporate customers, who cannot deduct VAT from the financial services they purchase. The tax exemption mainly benefits retail customers in the form of lower retail prices. The claim that the VAT exemption causes the sector to be undertaxed is false”, says Kauppi.

Nearly €400 million in sector-specific additional payments

In addition to the national taxes and contributions, credit institutions pay stability contributions to the EU Single Resolution Fund. In 2021, the Financial Stability Authority collected a total of €270 million in stability contributions from Finnish credit institutions. Credit institutions and banks also paid a total of €128 million in deposit guarantee contributions to the Financial Stability Authority.