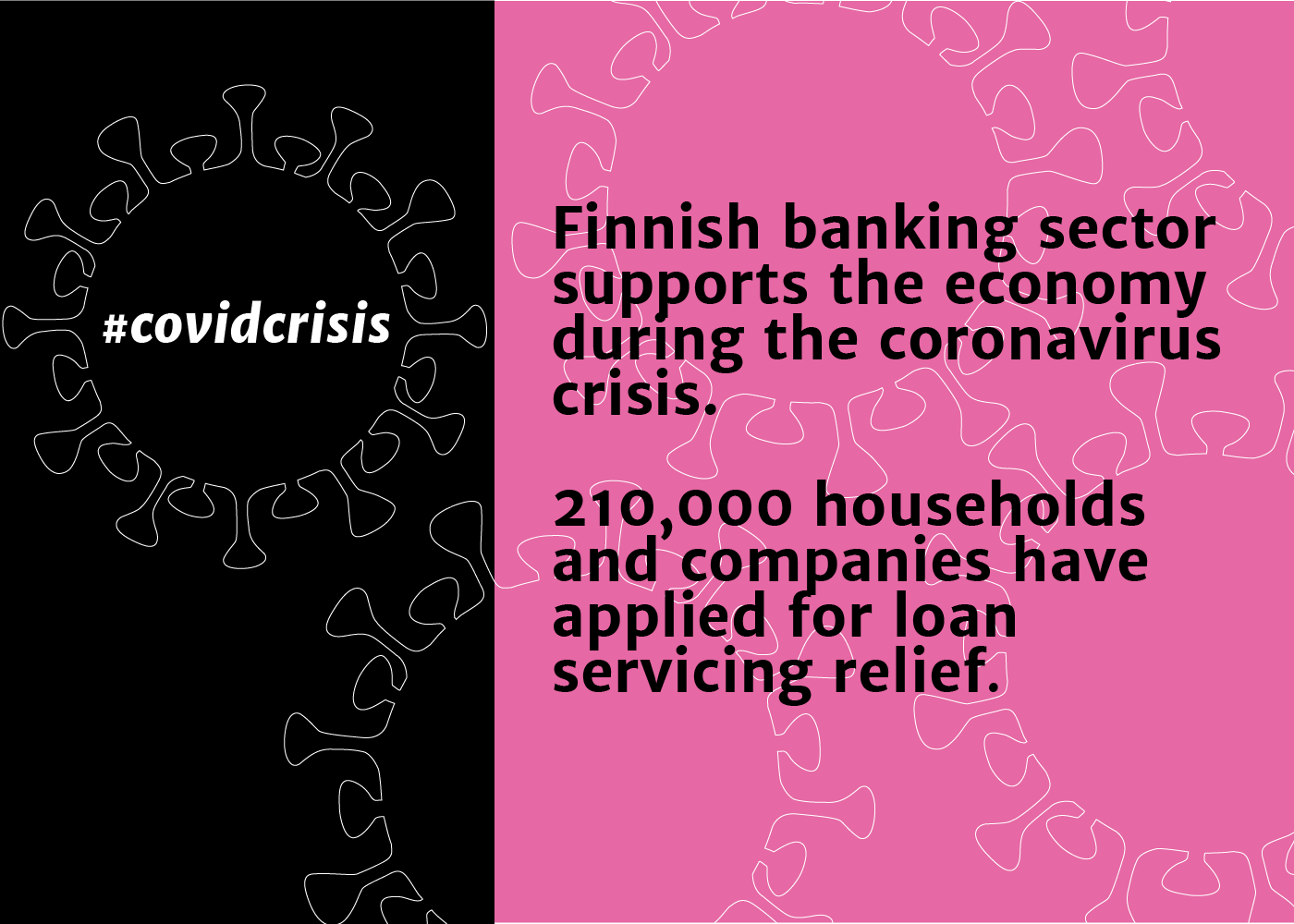

The Finnish banking sector is committed to helping its retail and corporate customers through the coronavirus crisis. Concrete evidence of this are the more than 200,000 loan servicing arrangements granted to existing customers. This public declaration by the Finnish financial sector describes the ways in which the sector has contributed to the common efforts to facilitate economic recovery. Each bank decides its relief measures individually and on a case-by-case basis. The financial sector is working together with the government and the authorities to carry our economy and national well-being safely through the crisis. Close public-private partnership shows its strength in these unusual times.

The Finnish banking sector is working together with the government and the authorities to carry Finland’s economy and national well-being safely through the coronavirus crisis. We need cooperative effort to avoid the bankruptcies of viable businesses and prevent the rise of unemployment. The close partnership of the Finnish public and private sectors shows its strength in these unusual times.

A financially solid banking sector is one of the keys to solving the current economic crisis. The Finnish Financial Supervisory Authority (FIN-FSA) reported in March that Finnish banks’ resiliency against operating environment disruptions is higher than European average. However, the drop in the value of investments and the substantial weakening of the real economy will unavoidably start to affect banks the longer the crisis draws on.

The decisions of the Finnish government, the Bank of Finland, FIN-FSA, the European Central Bank (ECB) and the European Banking Authority (EBA) support the capacity of the sound Finnish banking sector to finance households and businesses that have run into payment difficulties because of the crisis. The guarantees granted by the state-owned specialised financing company Finnvera reduce banks’ credit risk from new crisis-related lending to SMEs. The Bank of Finland and the State Pension Fund have also made decisions to purchase commercial papers from the market, which will also help businesses beat their payment difficulties. FIN-FSA has lowered banks’ capital requirements. ECB and EBA have also relaxed requirements as permitted by banking regulation.

Banks are strongly committed to the common crisis effort and strive to help their customers through the crisis, for example by negotiating more flexible arrangements on existing contracts. Each bank makes its arrangements individually and on a case-specific basis. The terms and conditions for services vary between banks, but grace periods and other flexible arrangements can usually be granted if the customer had no pre-crisis loan servicing difficulties and the bank estimates that the customer’s repayment ability will return to normal after the crisis.

Despite the crisis, banks must continue to assess and measure risks accurately. Banking regulation requires detailed reporting and the careful evaluation of customers’ economic situation and repayment ability.

Banks have been aiding – and continue to aid – households and companies with the following bank and customer-specific measures:

- Granting new loans (working capital loans, investment loans, home loans, consumer credits, etc.)

- Granting loan grace periods

- Relaxing payment schedules, merging loans, and making other arrangements to lower the customer’s monthly sums to be paid

- Extending credit limits

- Granting grace periods to credit card bills

- Giving possible discounts on service fees e.g. in connection to grace periods

- Offering financing advice to entrepreneurs

- Building corporate funding solutions cooperatively with other financial sector entities

- Adjusting tenancy agreements in bank-owned rental premises

- Ensuring that online services run smoothly and securely

- Providing a diverse selection of hygienic and secure payment methods

This is not the first time Finns are facing difficult challenges together. As before, teamwork is the way through. Once the acute phase of the crisis is over, banks stand ready to finance economic recovery and thus give rise to new prosperity and well-being in Finland.

Still have questions?

|Contact FFI experts