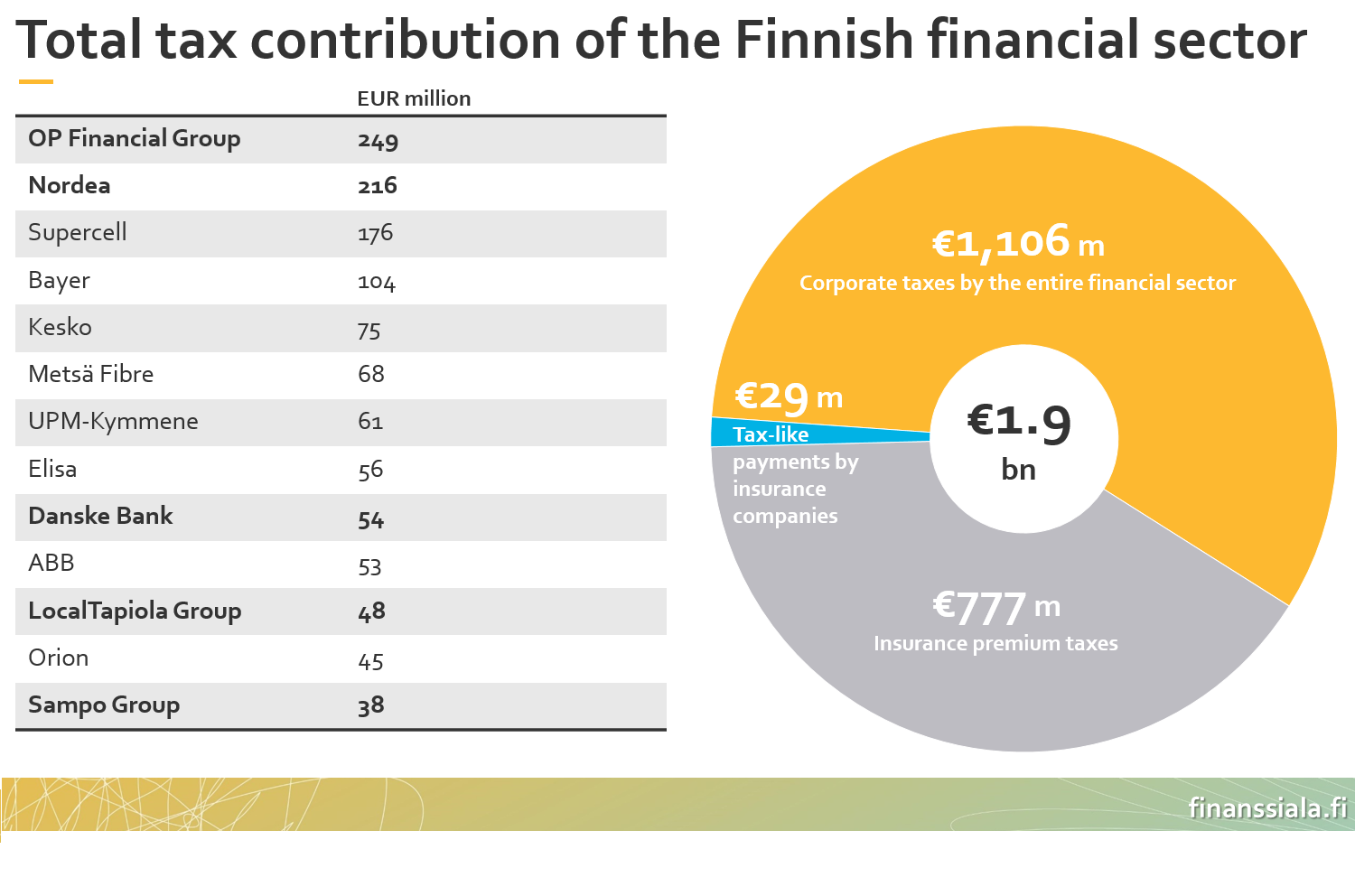

The Finnish financial sector made a total tax contribution of €1.9 billion in 2015. The figure is based on preliminary calculations by the Federation of Finnish Financial Services (FFI). It includes all the direct and indirect taxes paid by financial sector companies.

According to the latest tax information, financial sector companies continue to be the biggest contributors to corporate taxes in Finland. The corporate tax paid by the sector was about €1.1 billion, which is roughly 25% of Finland’s total corporate tax income. The thirteen largest payers included five financial sector companies. Total corporate tax income increased by 1.4% from the previous year to €4.5 billion.

The largest corporate tax payer is OP Financial Group (€249m), followed by Nordea Group (€216m). The other major payers in the financial sector include Danske Bank (€54m), LocalTapiola (€48m), and Sampo Group (€38m, including If P&C Insurance Company and Mandatum Life).

In addition to corporate tax, insurance companies accumulated €777 million as insurance premium tax, which follows the standard rate of VAT.

The Finnish financial sector employs about 40,000 people. The overall tax footprint of the financial sector is more than €4.5 billion. The sum includes taxes withheld from employee salaries and statutory payments related to employees.

Kauppi: Financial sector is a responsible promoter of Finnish welfare

“A tax contribution of nearly two billion is a good indication of how important the financial sector is for protecting the Finnish welfare society. Banks and insurance companies have performed well, and the society benefits from it in the form of tax income”, FFI’s Managing Director Piia-Noora Kauppi says.

Kauppi emphasises that the occasionally emerging claims of the financial sector being under-taxed are not factual. “The tax information published yesterday speaks for itself. In no case should Finland follow the example of Sweden, where the government has proposed a payroll-based financial activity tax on banks.”

According to Kauppi, the financial sector’s capacity to support economic growth will weaken if the sector’s taxation and already strict capital requirements are raised. “We must keep in mind that at worst, unreasonable taxation may cause functions, jobs, assets, liabilities, and equity to flow out of Finland.”

Still have questions?

|Contact FFI experts