The Finnish pension system is one of the best in the world. This has been shown many times, for example by the comparison conducted by the Finnish Centre for Pensions, the Global Pension Index, and the analysis by Blacktower Financial Management. Statutory employee pension provides a solid basis at the individual level, but everyone would still be wise to put money aside to prepare for old age.

The different kinds of pension saving instruments such as voluntary pension insurance and long-term savings accounts have been good ways to save up. The political decisions made over the years, however, have made the taxation of these products so unpredictable that barely any new supplementary pension policies are taken out anymore.

======

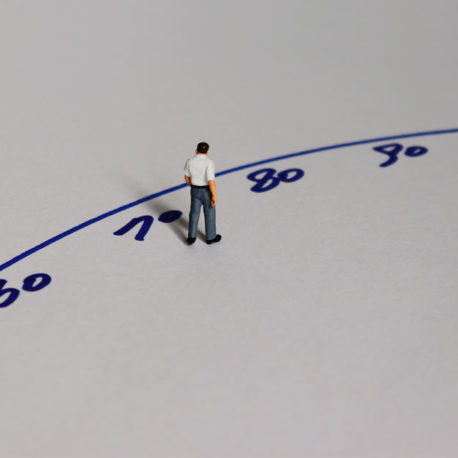

In the early 2000s, over 90,000 new pension insurance contracts

were signed each year. Now their number has fallen to a few hundred.

======

Europeans are ageing. The EU has awoken to the need for voluntary pension saving in its PEPP Regulation, which establishes the legal foundation for a pan-European Personal Pension Product (PEPP), a voluntary personal pension scheme that could be offered across the EU with standardised core features.

With the PEPP, the EU seeks to develop the European market for pension saving. It wants to provide citizens with better opportunities for boosting the adequacy of their pension savings. The EU also wants to respond to the challenge of population ageing, supplement existing pension products and schemes, and promote long-term investment in personal pensions. Many are hoping the PEPP will become a viable option of personal pension saving especially for workers who move across borders. As such, the PEPP’s role would still be to merely complement existing public and occupations pension systems.

We think the EU’s objective of boosting voluntary personal pension saving is highly supportable.

Finland should also promote and encourage voluntary financial preparedness for retirement. Unfortunately, the country has rather held on to a policy which seeks to suppress supplementary pension saving – and which has succeeded in this goal. The ongoing discussion has highlighted how this Finnish attitude is in clear conflict with the EU’s general objectives and policies regarding supplementary pensions.

The ship hasn’t yet sailed for Finland, though. Various taxation changes have subdued the demand and supply of personal pension products, but this does not mean there is no interest in saving. In fact, survey results suggest the exact opposite: citizens are motivated to save for retirement using the full range of different instruments.

Voluntary pension products should appear as attractive and uncomplicated to potential savers as other investment products. An important way to activate voluntary pension saving would be to enable the withdrawal of savings at retirement. At the moment, new contracts only allow this after the age of 68–70.

We should work to steer the savings of European and Finnish citizens towards long-term investment products such as voluntary pensions. This would work to the advantage of citizens, who would get better returns and more adequate pensions, and would also benefit the national economy.

Looking for more?

Other articles on the topic

Less than a third of Finns believe they can live on statutory pension alone – Chair of Finance Finland’s Board Sara Mella: Pension saving also supports economic growth

Finland back in the top five in international pension comparison – ranked the most transparent and reliable pension system in the world

Europe promotes pension saving – why is Finland lagging behind?

Finland once again among the top ten pension systems