- Financial sector companies’ consideration of climate change has grown steadily in the past five years, shows Finance Finland’s annual survey.

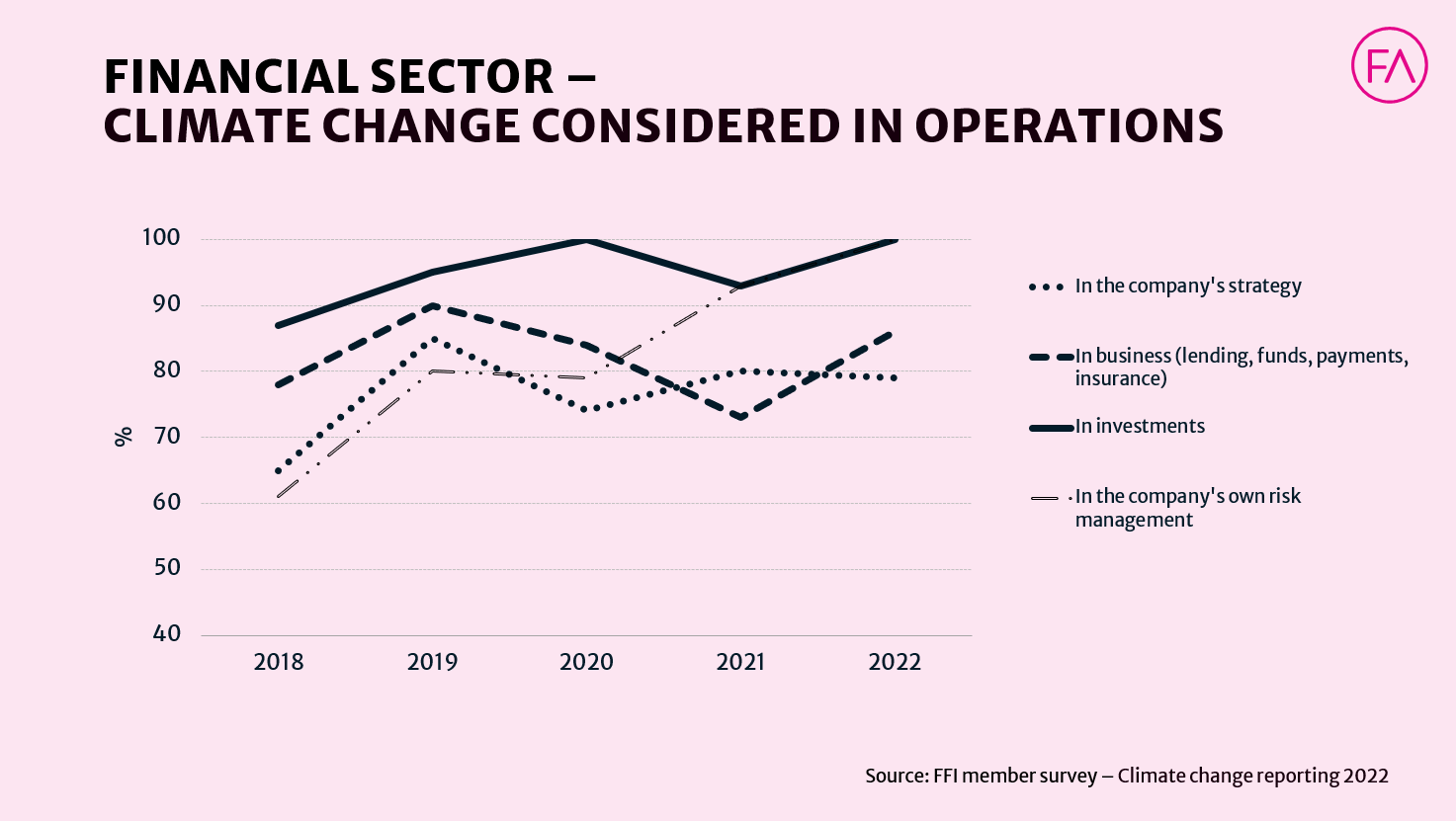

- All of the respondent companies said they took climate change into account in their investments and risk management in the survey year 2022.

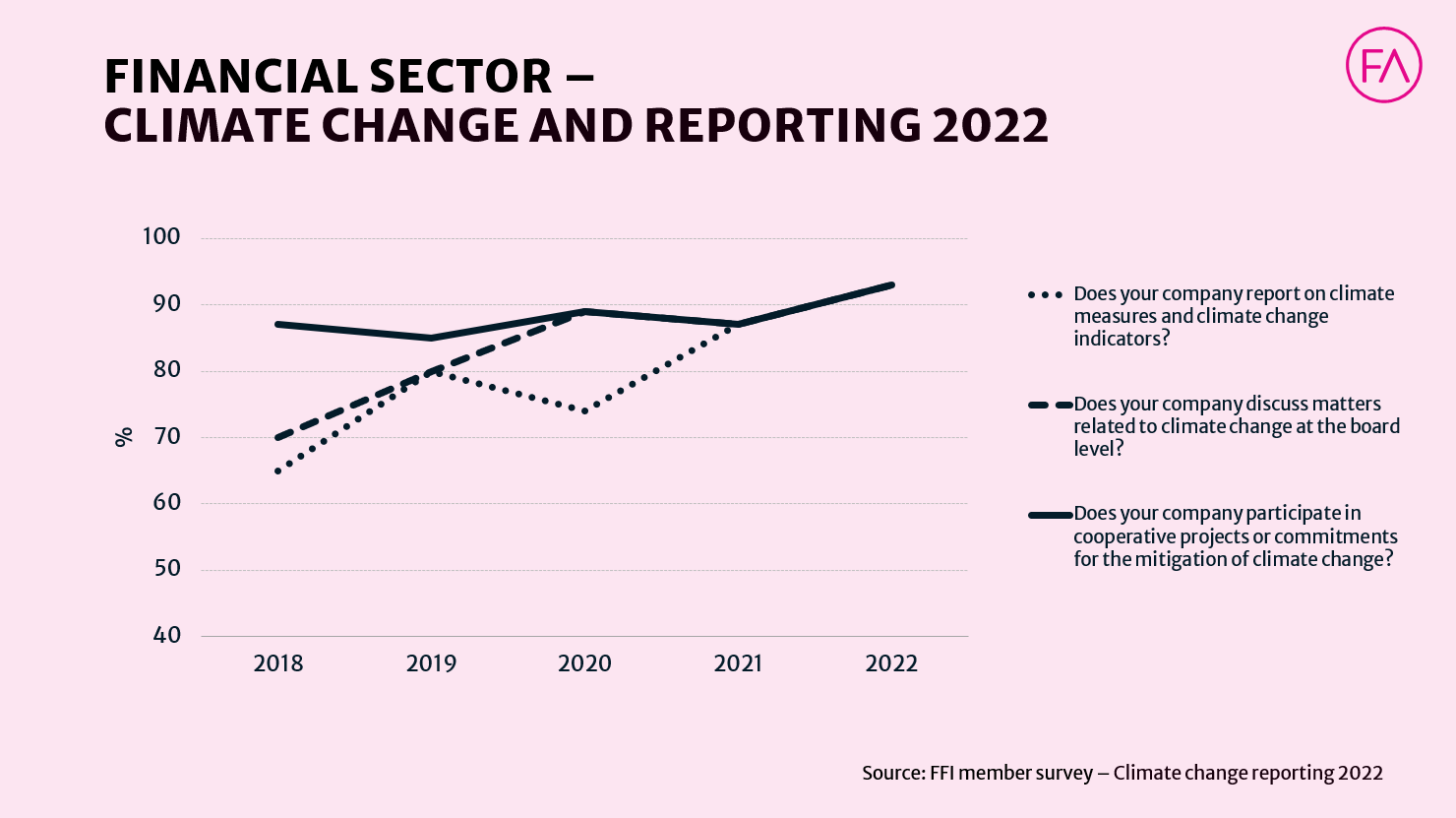

- 93% of the companies regularly reported their climate measures, participated in climate commitments or projects and discussed climate-related issues at the board level.

Finance Finland (FFI) has tracked the climate work of Finnish financial sector companies through an annual climate indicator survey since 2018 to improve the transparency of the sector’s climate-related measures. The FFI Board ruled in 2017 that the Finnish financial sector endorses the goals of the Paris Climate Agreement to limit global warming. To support this work, Finance Finland launched the annual survey on its member organisations’ climate action and climate considerations in lending, investment, non-life insurance and payments. The year 2022 was the last year to be surveyed.

The climate measures of Finnish financial sector companies were tracked over a period of five years. The survey results show steady growth in all of the indicators. In the last survey round, 100% of the respondent companies said they had integrated climate change consideration into their risk management. In the first survey in 2018, this figure was a mere 61%.

“It’s been a joy to see the figures rise year by year. The steady improvement shows that the sector’s climate consideration is not just empty words but that companies are taking practical climate action in their business operations”, says Chair of the FFI Responsibility Committee Kaarina Saramäki from OP Financial Group.

All respondents had integrated the consideration of climate change also into their investment operations. This figure has been high since the first survey.

“A sensible investor considers the risks of an investment well in advance. This provides a good opportunity to discuss with potential investees and encourage them to reduce their emissions and develop the funded operations in a more sustainable direction.”

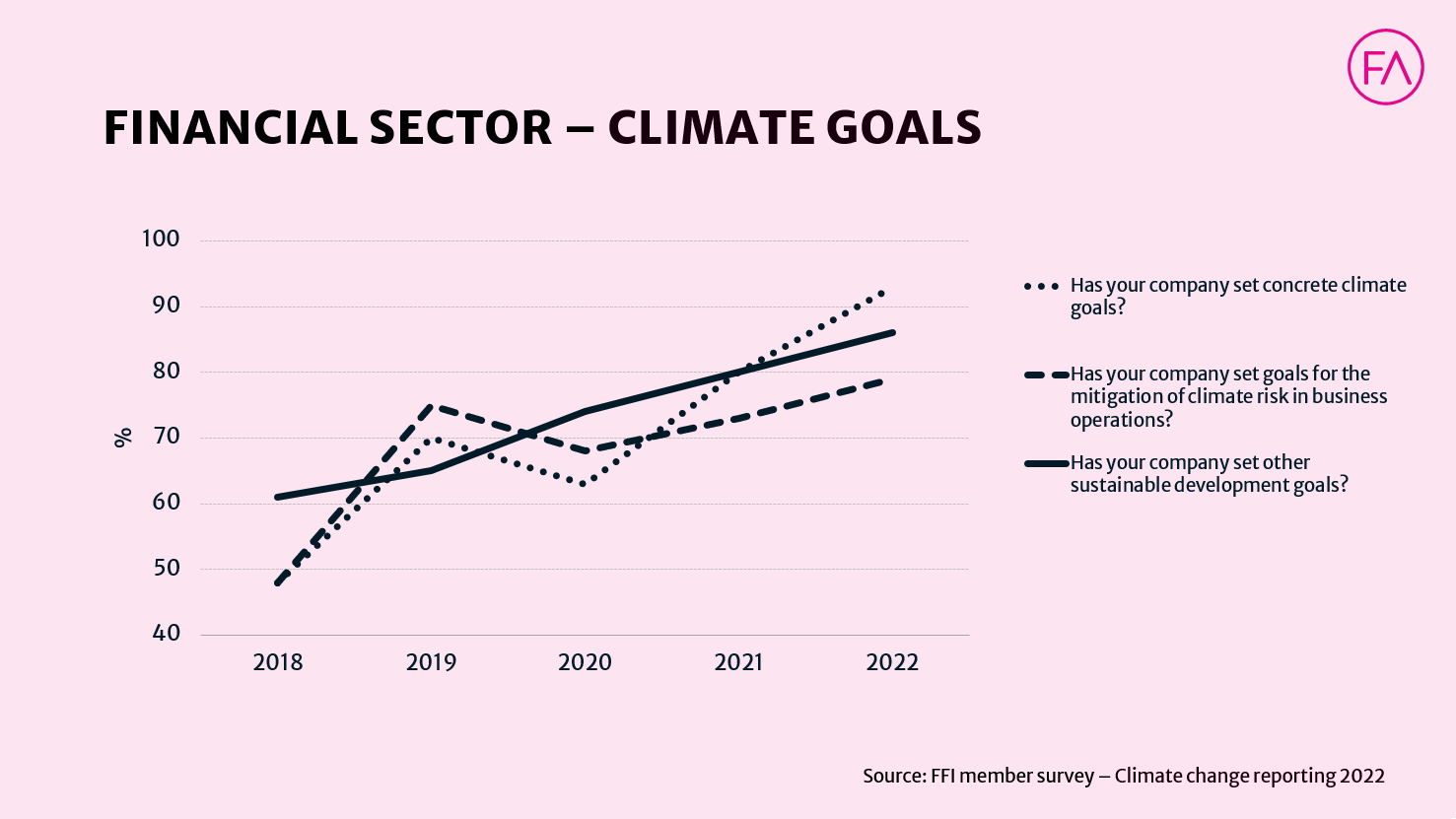

Since the beginning of the survey, there has been a clear upward trend also in whether the companies set concrete climate goals and discuss climate-related matters at the board level. In 2023, as many as 93% of the companies responded with ‘yes’ to the related questions.

There is nevertheless still room for improvement. Climate change consideration is included in the strategy of 79% of the respondent companies. This, too, is an increase compared to the first survey’s 65%, and Saramäki is confident that the figure will only keep rising in the coming years.

“Climate change and biodiversity loss are two of the most significant factors influencing the operating environment. Such fundamental forces of change are sure to reflect on business strategies.”

Final year of the survey

Launched in 2018, Finance Finland’s climate indicator surveys were now conducted for the last time. Time and regulation have overtaken the survey and its set of indicators.

“When the survey was started, the amount of regulation and different reporting obligations was much smaller. Today, companies collect large volumes of data for their sustainability reporting and also report in much more detail, so the survey is losing its relevance”, Saramäki explains.

The number of respondents has also diminished over the years. In the first survey round, 23 financial sector companies or groups took part in the survey, whereas this year they numbered only 14.

Still have questions?

|Contact our experts

Looking for more?

Other articles on the topic

Hooray for simplifying regulation! But obligations must be streamlined thoughtfully, without compromising environmental goals

Preventing biodiversity loss must be given top priority – also in business

Sustainable finance reporting requirements must not be reduced at the expense of the environment

Finnish financial sector signs nature commitment to enhance the transparency of its biodiversity action