- Review of the Banking Union’s bank crisis management and deposit insurance framework (CMDI) is presently under discussion in the EU.

- Establishing a European deposit insurance scheme (EDIS) should not be hurried. The issues of unhealthy banks must first be solved.

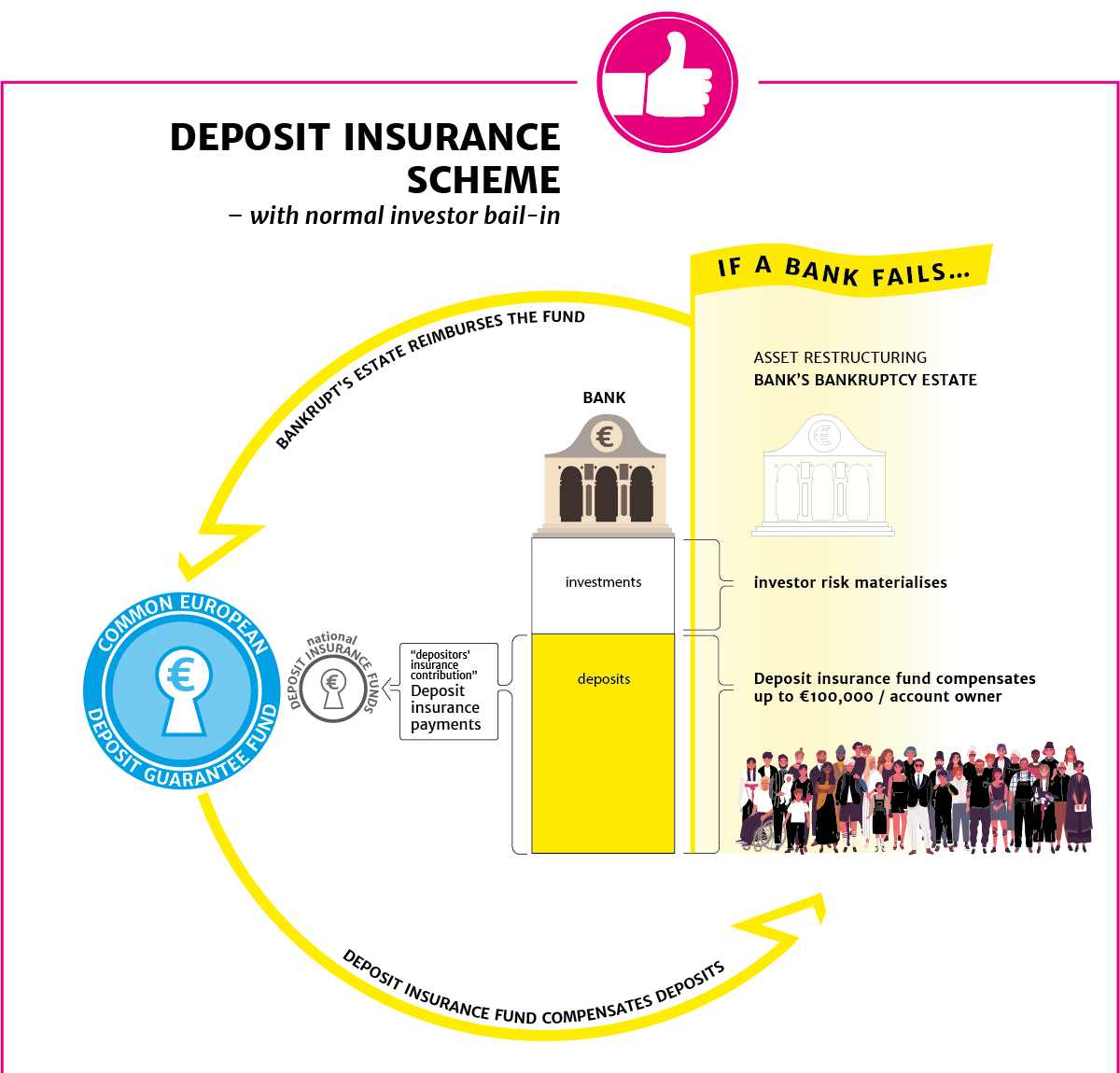

- If an EDIS is implemented, the scheme should be lending-based. Potential losses must be covered at national level.

- The Banking Union was one of the topics of the Eurogroup’s meeting on 17 June and will be discussed in the European Council’s meeting on 24–25 June.

- The Commission will present legislative proposals of the CMDI by the end of the year.

The Finnish financial sector is committed to the main objective of the banking union: improving the stability of the EU banking system. The single rulebook and harmonised risk assessment are ideas worth supporting, and the same goes for single banking supervision and the crisis resolution mechanism.

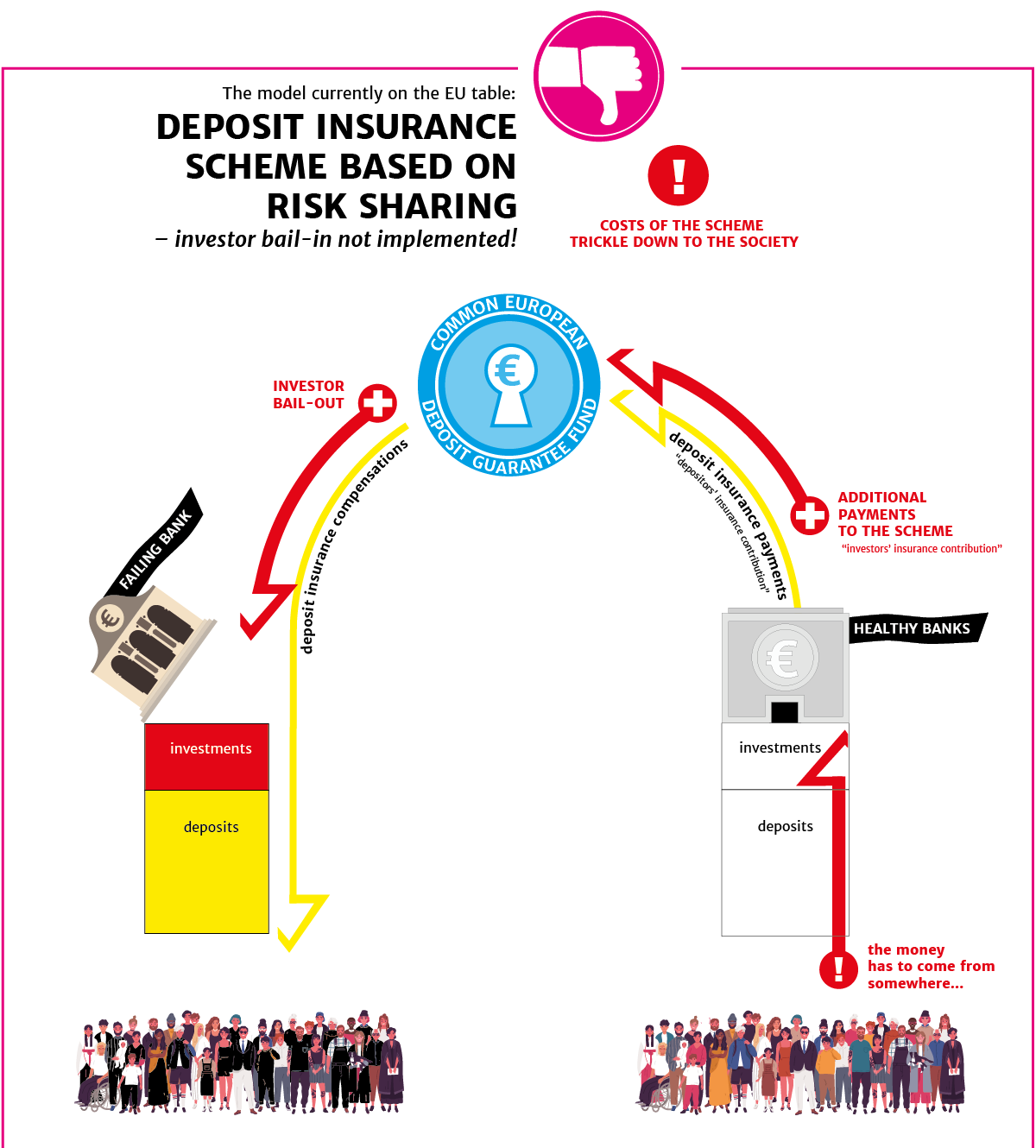

“The problems of unhealthy banks must first be solved. Liquidation and asset transfers must be financed first and foremost through investor bail-in”, comments FFI’s Head of Banking Regulation Olli Salmi.

If a common deposit insurance scheme is implemented, it must be based on lending rather than risk sharing. Potential losses must be covered at national level.

The Finnish Government stands with the financial sector on this subject. According to the Government Report on EU Policy in January, Finland’s basic premise in completing the Banking Union is based on a comprehensive and effective implementation of bail-in so that the costs for taxpayers could be minimised in the case of bank crises. Risk-sharing in the Banking Union should, however, be based on a fair insurance-type mechanism where the bank contributions for a common deposit insurance reflect the underlying risks. Risks must be reduced before advancing with the Banking Union.

“Every member state’s own banking system and every individual bank must reach a healthy financial situation. Only then can we proceed to completing the Banking Union”, Salmi states.

The future of the Banking Union was discussed in Finance Finland’s EU Round Table webinar on 17 March. In addition to the financial sector’s own representatives, the speakers included Director-General of DG FISMA John Berrigan, Member of the European Parliament Eero Heinäluoma, and the Finnish Permanent Under-Secretary for International and Financial Markets Affairs Leena Mörttinen.

Watch a recording of the FFI webinar on the completion of the Banking Union

Still have questions?

|Contact FFI experts

Looking for more?

Other articles on the topic

National liability must come before liquidity assistance – Finance Finland’s summer party panel focused on the European deposit insurance scheme

Banking Union’s Single Resolution Fund reached its target level – the criteria for accessing the fund must be kept strict

The Government and the Commerce Committee adopted a constructive stance on furthering the Banking Union – investor bail-in must not be scrapped

As deposit guarantee and bank resolution are being developed, bail-in must not be forgotten