- Finance Finland supports the creation of a science-based sustainability classification in the EU. We do not, however, take any stand on what the criteria for eligible economic activities should be like outside of the financial sector.

- The EU Taxonomy is one piece in the EU measures to promote sustainable finance. The regulatory package is still unfinished, and work on the Taxonomy is in the relatively early stages as well.

- The financial sector’s opportunities to steer the business world towards environmental sustainability by means of financing, lending and insurance will improve as the legislative work gradually progresses.

“The taxonomy is not the financial sector’s own definition of environmentally sustainable activities or undertakings”, emphasises Markus Lindqvist, Aktia’s director in charge of sustainability.

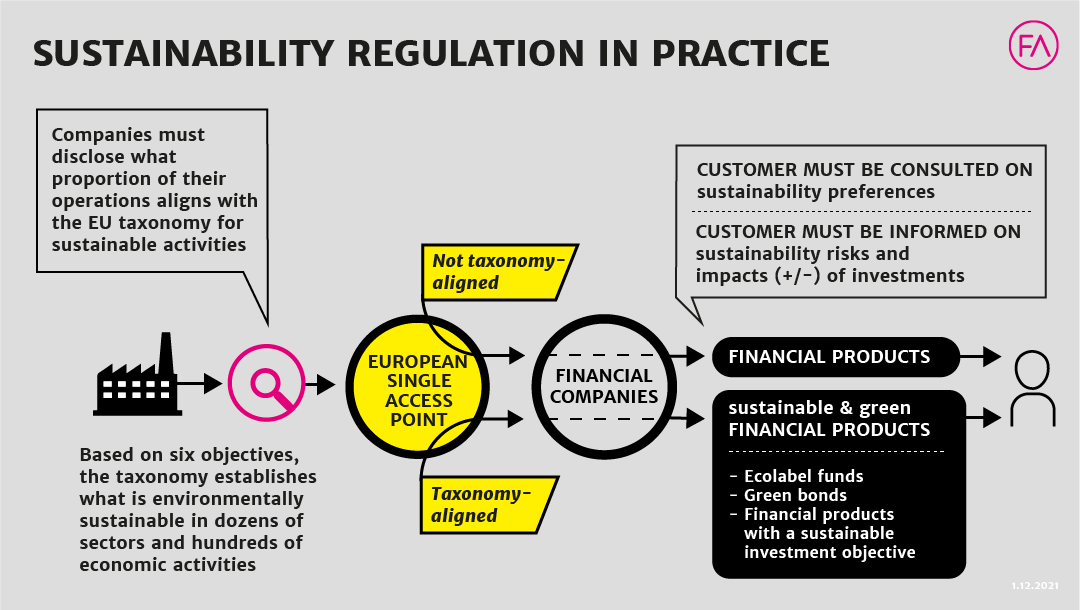

The EU Taxonomy Regulation determines what kind of economic activities can be classified as environmentally sustainable. A company can have some operations that are taxonomy-aligned and some that are not. Individual companies are therefore not branded good or bad: their sustainability is examined separately for each activity.

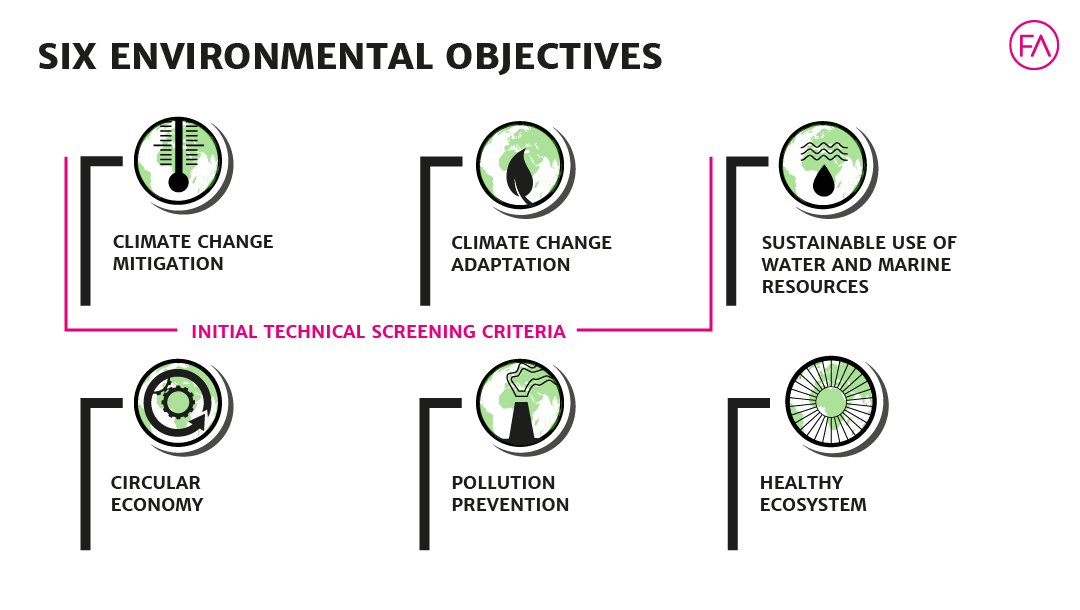

The Taxonomy divides environmental sustainability into six goals. So far, agreement has been reached on the specific contents of the two climate-related goals.

The work is moving forward in stages. As of this January, large public-interest companies with more than 500 employees have been required to report on the extent to which their activities are aligned with the Taxonomy. Presumably this reporting obligation will be extended also to smaller companies when the EU CSRD is reviewed.

Finance Finland: Uniform rules are essential

The Taxonomy has gained a lot of media attention in Finland especially due to its potential impact on the country’s forest industry. These concerns were eventually weighty enough for Finland to vote against the EU Taxonomy Climate Delegated Act. However, the majority of other member states voted in favour, and the criteria entered into force at the start of 2022.

Next up for trial will be the role of nuclear energy and natural gas-fired power. The EU Commission proposes the inclusion of these energy sources in the Taxonomy. Both are important for many European countries as they transition towards carbon neutrality, and Finland therefore supports the inclusion of nuclear energy.

According to expert assessments (report 1 and report 2), nuclear power and fossil gaseous fuels do not fulfil the Taxonomy definition for “green” activities that make a significant contribution to climate protection. As transitional energy sources they could, however, fit in the “amber” category currently being prepared by the EU Platform on Sustainable Finance.

Finance Finland has refrained from commenting on the technical details for the other sectors and industries, because their evaluation requires in-depth expertise in subject areas outside of the financial sector.

“We consider it paramount that the Taxonomy is based on scientifically researched information on what constitutes sustainable economic activity. The classification must be reliable and credible to gain traction in the markets”, says Finance Finland’s Special Adviser in Sustainable Finance Venla Voutilainen. “There is a risk that the controversial inclusion of nuclear power and natural gas against common market practice will slow down the application of the Taxonomy.”

“It’s important to keep in mind that the Taxonomy is meant as a voluntary transparency tool”, Voutilainen emphasises. “The Taxonomy does not ban any kind of financing or investment. The only obligation is reporting.”

But taxonomy alignment in itself does not yet indicate environmental sustainability. How does this work out?

Lindqvist gives an example:

“If you apply for a car loan, this constitutes a taxonomy-eligible object of financing for the bank. However, this says nothing about the taxonomy alignment of the activity: to determine the latter, more information is needed on the car that is being purchased. An electric car, for example, could be considered sustainable, but a heavily polluting diesel car would not.”

Private car transport is covered by the Taxonomy, which makes car financing taxonomy-eligible. But the taxonomy eligibility of a loan granted to, for instance, an agricultural entrepreneur cannot be assessed, because the inclusion of the sector or the criteria for it have not been decided yet.

What about retail investors?

The Taxonomy will not open the pearly gates of sustainable investment for retail investors, at least not yet. Rather, the Taxonomy is a progressive tool meant for professionals, which together with the other sustainable finance regulations makes the financial sector better equipped for more sustainable financing, lending and insurance decisions. Taxonomy alignment is nevertheless a detail that retail investors interested in the sustainability of their investments can watch out for in the coming years.

Various commercial actors have for years attempted to score businesses in terms of their sustainability. The scoring of an individual company may have varied greatly depending on the scoring system. This has resulted from the lack of a uniform understanding of what is sustainable and responsible. The objective of the EU Taxonomy is to establish a uniform, science-based definition of sustainability that would be applied in the entire EU area.

“The valuation of sustainability is not purely quantitative. We also need qualitative indicators. How are the three commonly used aspects of responsibility – environment, social and governance – interrelated? At this stage, the Taxonomy is only focused on the climate change objectives. This excludes the activities of medical companies, for example: while highly important, they do not have a significant impact on climate change”, Lindqvist explains.

Promoting sustainability is not a sprint but a marathon. “We will have a fuller picture once the Taxonomy is expanded to include other criteria besides climate change mitigation and adaptation”, he says.

What we do know is that the remaining four environmental goals will get their own technical criteria during 2022. The EU is also working on a taxonomy for socially sustainable economic activities, which could also include the previously mentioned medical companies under certain conditions.

Despite the professional focus of the Taxonomy, a retail investor aspiring to sustainability does not have to sit idle. For a start, they can take a closer look at the sustainability reporting of investment funds. EU regulation currently enables the classification of ESG funds as “light green” or “dark green”. A retail investor can learn much about a fund’s sustainability performance by keeping an eye on these labels. At the moment, the majority of funds are not in either category.

Looking for more?

Other articles on the topic

Clear and uniform sustainable finance regulation enhances the EU’s competitiveness

The EU Sustainable Finance Disclosures Regulation has promise but lacks in execution

Will the wild west of ESG ratings soon be history? – New regulation facilitates the assessment of sustainability factors

The financial sector has power to halt biodiversity loss – International experts presented their measures in Helsinki