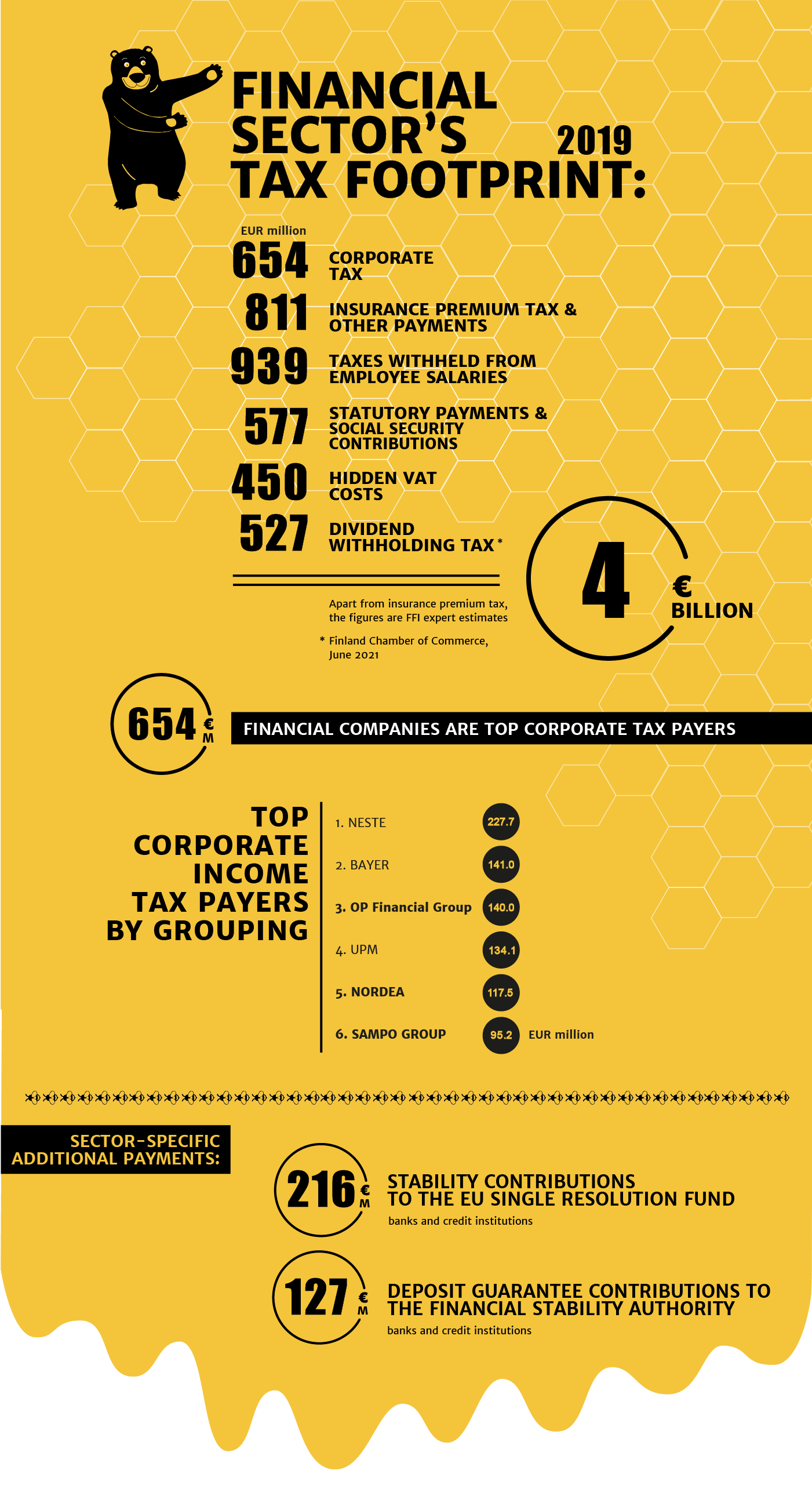

The financial sector was again one of the biggest taxpayers in Finland according to 2019 tax data released by the Tax Administration. The top six payers of corporate tax in Finland included three financial sector companies: OP Financial Group (ranking 3rd), Nordea (5th), and Sampo Group (6th). In total, the sector paid €654 million in corporate tax, amounting to about 11.2% of all corporate tax in Finland. This was €25 million less than in 2018.

The Finnish financial sector employs approximately 43,000 people. The sector pays corporate tax (€654 million), insurance premium tax (€789 million), and contributions towards fire protection, road safety and industrial safety (€22 million). Moreover, the sector generates employee income tax (€939 million), social security contributions (€577 million) and dividend withholding tax (€527 million) and pays non-deductible VAT for approximately €450 million. Combined, this creates a tax footprint of approximately 4 billion euros.

The amount of withholding tax levied on dividends paid by the sector is based on an annual study on the taxation of Finnish companies published by the Finland Chamber of Commerce in June 2021. Apart from insurance premium tax, the other figures are FFI expert estimates.

Kauppi: The financial sector must remain an enabler of economic growth in the aftermath of the coronavirus crisis

“The financial sector is a responsible enabler and builder of well-being in society. Any occasional claims that the sector is under-taxed are far from the truth. The sector’s good financial standing has made it possible to offer more flexible loan arrangements for households and corporations, and new lending has also remained strong”, says Piia-Noora Kauppi, managing director of Finance Finland (FFI).

Kauppi emphasises that the sector must remain vital, competitive, and financially sound when Finland battles the coronavirus. Therefore, the regulatory burden of the sector must not be increased.

“As long as the sector is not hindered with new regulatory burdens, it can continue financing households and companies, provide insurance, and offer investment options. As we’re trying to create new economic growth after the crisis caused by the coronavirus, it is important that the sector can continue to function normally without added regulatory burden”, Kauppi states.

Largest payers of corporate tax in the financial sector

Finland’s top corporate taxpayer in 2019 was Neste, followed by Bayer in second and OP Financial Group in third place. In the financial sector, the top payers after OP Financial Group (€140m) were Nordea (€117.5m, 5th place), Sampo Group (€95.2m, 6th), LocalTapiola and Turva (€44.2m, 14th), and Danske Bank (€24.9m, 22nd). FFI compiled the financial sector data based on public information provided by the Finnish Tax Administration.

Hidden VAT costs of €450 million euros

Financing and insurance services are exempt from value added tax according to the EU VAT directive. Therefore, unlike most companies, financial sector companies cannot deduct the VAT for the goods and services they purchase. FFI estimates this VAT amounted for approximately €450 million in 2019.

The VAT exemption is beneficial for individual retail customers, but for corporate customers, the non-deductible VAT raises prices compared to a scenario where companies could deduct VAT from their purchases. In this light, the claim that the VAT exemption causes the sector to be undertaxed is false.

EU stability contributions of €216 million

In addition to the national taxes and contributions, Finnish credit institutions paid stability contributions to the EU Single Resolution Fund for €216 million, as well as deposit guarantee contributions to the Financial Stability Authority for €127 million. In 2020 the stability contributions will rise to €235 million.

Sources used in the calculation of the sector’s tax footprint: Finnish Tax Administration, Statistics Finland, companies’ financial statements. KPMG, FFI.

Update 3 June 2021: Added information on the withholding tax levied on dividends paid by the sector. The amount of the dividend withholding tax is based on an annual study on the taxation of Finnish companies published by the Finland Chamber of Commerce in June 2021. Apart from insurance premium tax, the other figures are FFI expert estimates.

Still have questions?

|Contact FFI experts