- As of 1 August 2022, providers of investment advice have been required to collect information about their clients’ sustainability preferences to provide suitable recommendations or make suitable investment decisions on their behalf.

- Clients are asked, for example, whether they prefer environmentally sustainable investments and whether they want the social impact of their investments to be a deciding factor. Finance Finland believes that regulation will increase the demand for sustainable products and promote their development.

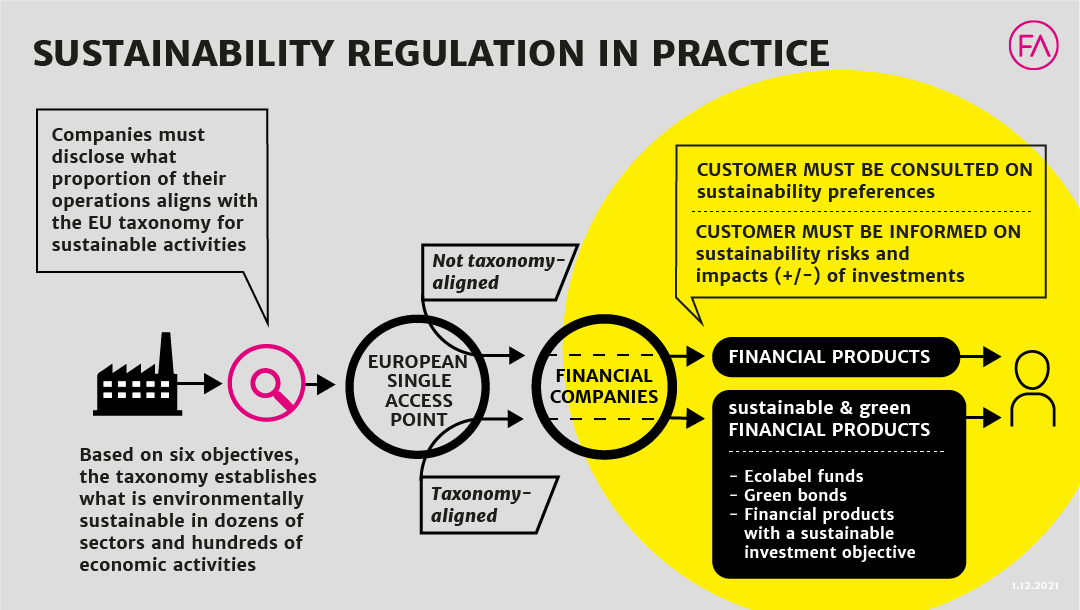

Incorporating ESG information into investment decisions is part of the EU sustainable finance package. One of its aims is to make responsible investing easier and more transparent. A clear-cut definition of ‘sustainable investing’ is still lacking because the EU Taxonomy, the classification of sustainable investments, is still incomplete. A retail investor may have to wait a few more years until the situation becomes less complex and suitable matches become available for all their preferences. With time, responsible investing will become easier.

When a new client decides to invest for example in a fund and contacts their bank to do so, they are now asked not only the usual questions about their expectations regarding yields, for example, but also about the desired sustainability impact of the investments. The same questions will also be asked from existing clients.

“When account managers or salespersons meet with clients, they’ll also discuss and update the client’s sustainability preferences according to a specific process. The same interview is conducted with all new clients”, says Petra Hakamo, Head of Sustainability at Evli Plc.

Sustainability preferences are assessed in three areas: firstly, how big a proportion of investments does the client want to allocate to taxonomy-aligned environmentally sustainable economic activities; secondly, what proportion do they want to allocate to otherwise (e.g. socially) sustainable activities; and thirdly, how much weight do they place on the consideration of principal adverse impacts, such as emissions or impact on water resources.

Finance Finland: The definition of sustainable investment is still unfixed

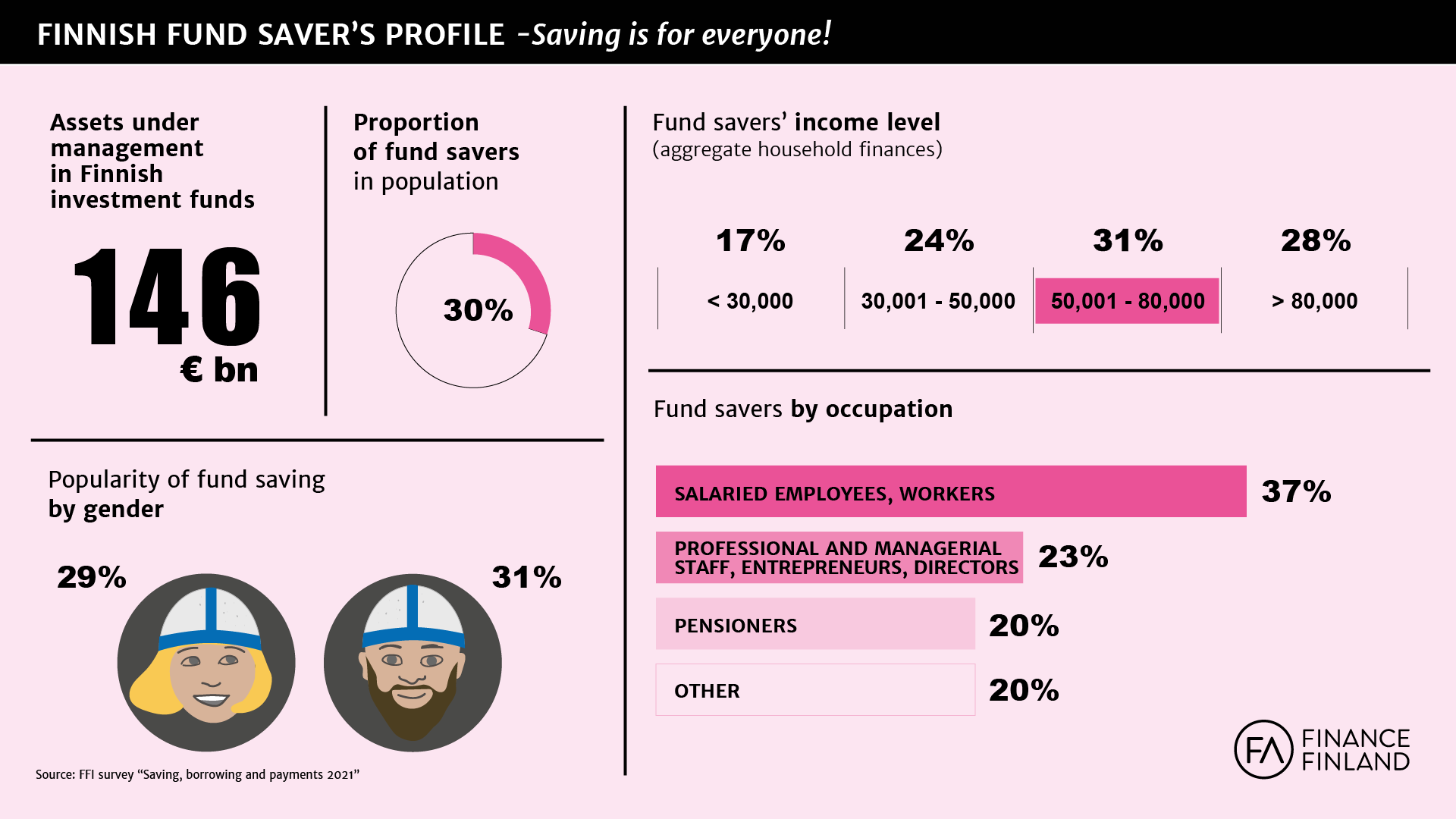

A large part of Finnish investors consider responsibility in their investment decisions, but almost equally many find it difficult to evaluate the impacts of investment products. One of the aims of sustainable finance regulation is to make this comparison easier for retail investors.

The regulatory package is not yet complete. A common set of adverse impact indicators has been created, but the EU Taxonomy is still missing the criteria in four out of its six objectives. The definition for socially sustainable investments is still in its early stages.

“Without indicators and definitions, we don’t have comparable data”, comments Head of Sustainability Venla Voutilainen from Finance Finland.

“Although investors are already asked about their preferences, standardised sustainability information on financial products will not be available until 2023.”

The good news is that the amount of information and understanding is growing steadily. The EU reached an agreement on corporate sustainability reporting in June. A global standard is also in the works, as is a European ESG information database.

“It’s important to realise that this need for an environmental and social sustainability shift applies to the entire society and the economy at large. We’re talking about a massive change, and it’s unlikely that we’ll ever reach a single, comprehensive definition of sustainability”, Voutilainen adds. “What matters are the factors behind different investment strategies – what steers investment decisions and how?”

OP Financial Group’s Head of ESG Annika Esono Manninen says that sustainability preferences differ from risk assessment in that regulation permits the adaptation of the client’s preference profile if matching financial products are not available.

“The risk level specified by the client must be followed to the letter, but if products that match the client’s sustainability preferences aren’t available, compromises can be made to find products that are as good a match as possible, provided that the client wants to do so.”

Sustainability preference inquiries are related to the second Markets in Financial Instruments Directive (MiFID II), which has from August required advisers to consider their clients’ sustainability preferences when conducting suitability assessments. This way, clients do not have to know how to articulate their sustainability preferences, because these preferences are asked as part of policy.

New sustainable finance products are continually developed. About half of all funds in the EU market already consider sustainability at least to some extent. However, it is possible that a product matching the exact preferences of a client is not always immediately available on the market.

The law of supply and demand naturally also applies in the investment market. Evli’s Hakamo believes that the new regulation will encourage investment service providers to develop new, more sustainable products as well as to improve the sustainability and responsibility of products already in the market.

“I believe that the products most highly ranked in terms of sustainability will keep increasing their popularity. Regulation may also encourage investees with a lower ESG score to improve their practices.”

Looking for more?

Other articles on the topic

Clear and uniform sustainable finance regulation enhances the EU’s competitiveness

The EU Sustainable Finance Disclosures Regulation has promise but lacks in execution

Will the wild west of ESG ratings soon be history? – New regulation facilitates the assessment of sustainability factors

The financial sector has power to halt biodiversity loss – International experts presented their measures in Helsinki